Form Inc 251 - Application For Extension Of Filing Time/prepayment Of Individual Income Tax

ADVERTISEMENT

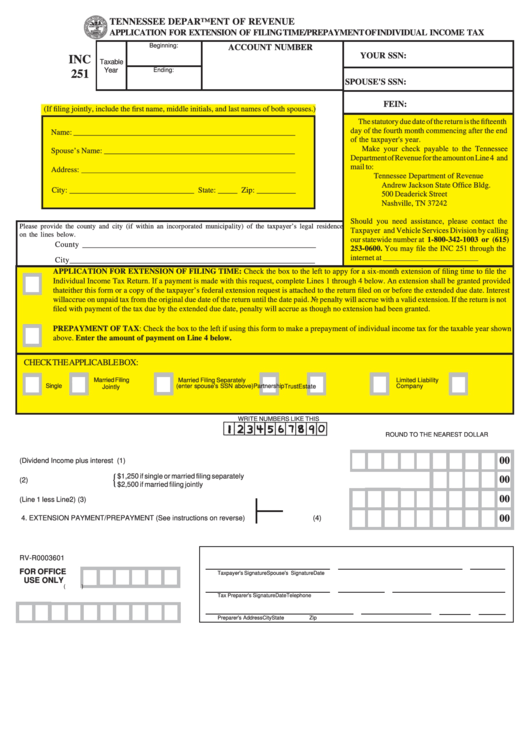

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR EXTENSION OF FILING TIME/PREPAYMENT OF INDIVIDUAL INCOME TAX

Beginning:

ACCOUNT NUMBER

YOUR SSN:

INC

Taxable

Year

Ending:

251

SPOUSE'S SSN:

FEIN:

(If filing jointly, include the first name, middle initials, and last names of both spouses.)

The statutory due date of the return is the fifteenth

day of the fourth month commencing after the end

Name: _________________________________________________________

of the taxpayer's year.

Make your check payable to the Tennessee

Spouse’s Name: _________________________________________________

Department of Revenue for the amount on Line 4 and

mail to:

Address: _______________________________________________________

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

City: ________________________________ State: _____ Zip: __________

500 Deaderick Street

Nashville, TN 37242

Should you need assistance, please contact the

Please provide the county and city (if within an incorporated municipality) of the taxpayer’s legal residence

Taxpayer and Vehicle Services Division by calling

on the lines below.

our statewide number at 1-800-342-1003 or (615)

County ____________________________________________________________

253-0600. You may file the INC 251 through the

internet at

City _______________________________________________________________

APPLICATION FOR EXTENSION OF FILING TIME: Check the box to the left to appy for a six-month extension of filing time to file the

Individual Income Tax Return. If a payment is made with this request, complete Lines 1 through 4 below. An extension shall be granted provided

thateither this form or a copy of the taxpayer’s federal extension request is attached to the return filed on or before the extended due date. Interest

willaccrue on unpaid tax from the original due date of the return until the date paid. No penalty will accrue with a valid extension. If the return is not

filed with payment of the tax due by the extended due date, penalty will accrue as though no extension had been granted.

PREPAYMENT OF TAX: Check the box to the left if using this form to make a prepayment of individual income tax for the taxable year shown

above. Enter the amount of payment on Line 4 below.

CHECK THE APPLICABLE BOX:

Married Filing

Married Filing Separately

Limited

Liability

Single

(enter spouse's SSN above)

Trust

Partnership

Company

Estate

Jointly

WRITE NUMBERS LIKE THIS

ROUND TO THE NEAREST DOLLAR

00

1.TOTAL TAXABLE INCOME (Dividend Income plus interest income....................................... (1)

{

$1,250 if single or married filing separately

00

2.SUBTRACT EXEMPTION

............................(2)

$2,500 if married filing jointly

00

3.AMOUNT SUBJECT TO TAX (Line 1 less Line 2)...................................

(3)

00

4. EXTENSION PAYMENT/PREPAYMENT (See instructions on reverse)

(4)

RV-R0003601

FOR OFFICE

Taxpayer's Signature

Spouse's Signature

Date

USE ONLY

(

)

Tax Preparer's Signature

Date

Telephone

Preparer's Address

City

State

Zip

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1