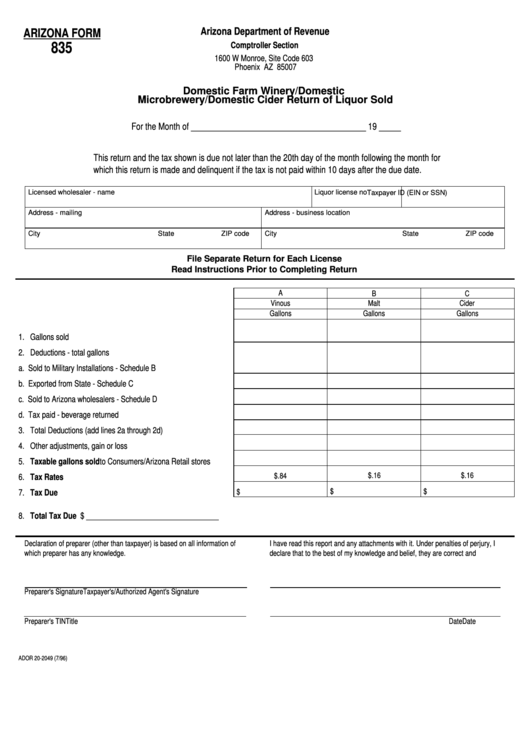

Arizona Department of Revenue

ARIZONA FORM

835

Comptroller Section

1600 W Monroe, Site Code 603

Phoenix AZ 85007

Domestic Farm Winery/Domestic

Microbrewery/Domestic Cider Return of Liquor Sold

For the Month of ________________________________________ 19 _____

This return and the tax shown is due not later than the 20th day of the month following the month for

which this return is made and delinquent if the tax is not paid within 10 days after the due date.

Licensed wholesaler - name

Liquor license no

Taxpayer ID (EIN or SSN)

Address - mailing

Address - business location

City

State

ZIP code

City

State

ZIP code

File Separate Return for Each License

Read Instructions Prior to Completing Return

A

B

C

Vinous

Malt

Cider

Gallons

Gallons

Gallons

1. Gallons sold ...............................................................................

2. Deductions - total gallons

a. Sold to Military Installations - Schedule B ............................

b. Exported from State - Schedule C .......................................

c. Sold to Arizona wholesalers - Schedule D ...........................

d. Tax paid - beverage returned ..............................................

3. Total Deductions (add lines 2a through 2d) ...............................

4. Other adjustments, gain or loss .................................................

5. Taxable gallons sold to Consumers/Arizona Retail stores ......

$.16

$.16

$.84

6. Tax Rates ..................................................................................

$

$

$

7. Tax Due .....................................................................................

8. Total Tax Due $ __________________________________

Declaration of preparer (other than taxpayer) is based on all information of

I have read this report and any attachments with it. Under penalties of perjury, I

which preparer has any knowledge.

declare that to the best of my knowledge and belief, they are correct and

Preparer's Signature

Taxpayer's/Authorized Agent's Signature

Preparer's TIN

Date

Title

Date

ADOR 20-2049 (7/96)

1

1 2

2 3

3