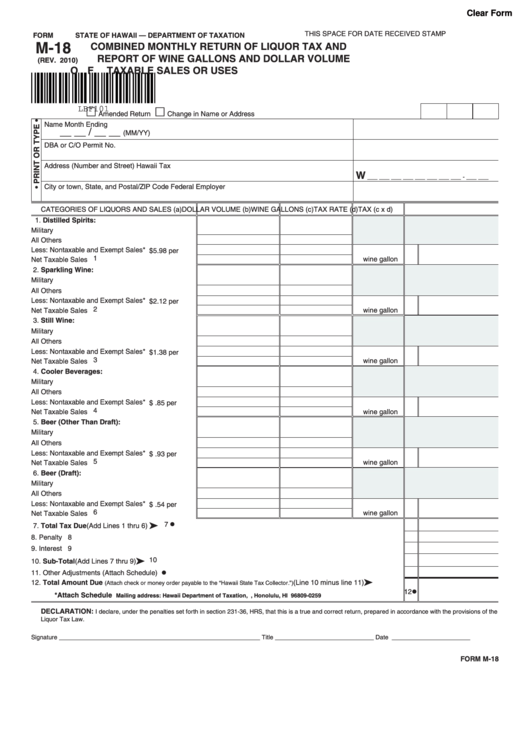

Clear Form

THIS SPACE FOR DATE RECEIVED STAMP

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

M-18

COMBINED MONTHLY RETURN OF LIQUOR TAX AND

REPORT OF WINE GALLONS AND DOLLAR VOLUME

(REV. 2010)

OF TAXABLE SALES OR USES

LBF101

Amended Return

Change in Name or Address

Name

Month Ending

__ __ / __ __

(MM/YY)

DBA or C/O

Permit No.

Address (Number and Street)

Hawaii Tax I.D. No.

W

___ ___ ___ ___ ___ ___ ___ ___ - ___ ___

City or town, State, and Postal/ZIP Code

Federal Employer I.D. No./Social Security No.

CATEGORIES OF LIQUORS AND SALES (a)

DOLLAR VOLUME (b) WINE GALLONS (c) TAX RATE (d)

TAX (c x d)

1. Distilled Spirits:

Military ............................................................

All Others .........................................................

Less: Nontaxable and Exempt Sales* ......

$5.98 per

1

wine gallon

Net Taxable Sales .....................................

2. Sparkling Wine:

Military .............................................................

All Others .........................................................

Less: Nontaxable and Exempt Sales* ......

$2.12 per

2

wine gallon

Net Taxable Sales .....................................

3. Still Wine:

Military .............................................................

All Others .........................................................

Less: Nontaxable and Exempt Sales* ......

$1.38 per

3

Net Taxable Sales .....................................

wine gallon

4. Cooler Beverages:

Military .............................................................

All Others .........................................................

Less: Nontaxable and Exempt Sales* ......

$ .85 per

4

Net Taxable Sales .....................................

wine gallon

5. Beer (Other Than Draft):

Military .............................................................

All Others .........................................................

Less: Nontaxable and Exempt Sales* ......

$ .93 per

5

Net Taxable Sales .....................................

wine gallon

6. Beer (Draft):

Military .............................................................

All Others .........................................................

Less: Nontaxable and Exempt Sales* ......

$ .54 per

6

Net Taxable Sales .....................................

wine gallon

7

7. Total Tax Due ........................................................................................................................... (Add Lines 1 thru 6)

8. Penalty ...........................................................................................................................................................................

8

9. Interest ..........................................................................................................................................................................

9

10

10. Sub-Total ................................................................................................................................. (Add Lines 7 thru 9)

11. Other Adjustments (Attach Schedule) ........................................................................................................................... 11

12. Total Amount Due (Attach check or money order payable to the “Hawaii State Tax Collector.”)............. (Line 10 minus line 11)

12

*Attach Schedule

Mailing address: Hawaii Department of Taxation, P.O. Box 259, Honolulu, HI 96809-0259

DECLARATION:

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in accordance with the provisions of the

Liquor Tax Law.

Signature ___________________________________________________________

Title _____________________________

Date _______________________

FORM M-18

1

1 2

2