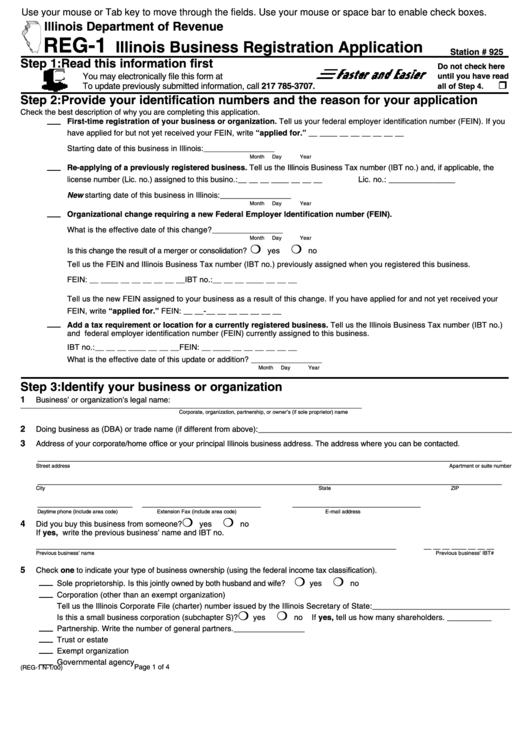

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REG-1

Illinois Business Registration Application

Station # 925

Step 1: Read this information first

Do not check here

You may electronically file this form at

until you have read

To update previously submitted information, call 217 785-3707.

all of Step 4.

Step 2: Provide your identification numbers and the reason for your application

Check the best description of why you are completing this application.

First-time registration of your business or organization. Tell us your federal employer identification number (FEIN). If you

have applied for but not yet received your FEIN, write “applied for.” __ __ __ __ __ __ __ __ __

Starting date of this business in Illinois:

________________

Month

Day

Year

Re-applying of a previously registered business. Tell us the Illinois Business Tax number (IBT no.) and, if applicable, the

license number (Lic. no.) assigned to this business.

IBT no.:__ __ __ __ __ __ __ __

Lic. no.: _______________

New starting date of this business in Illinois:

________________

Month

Day

Year

Organizational change requiring a new Federal Employer Identification number (FEIN).

What is the effective date of this change?

________________

Month

Day

Year

❍

❍

Is this change the result of a merger or consolidation?

yes

no

Tell us the FEIN and Illinois Business Tax number (IBT no.) previously assigned when you registered this business.

FEIN: __ __ __ __ __ __ __ __ __

IBT no.:__ __ __ __ __ __ __ __

Tell us the new FEIN assigned to your business as a result of this change. If you have applied for and not yet received your

FEIN, write “applied for.” FEIN: __ __-__ __ __ __ __ __ __

Add a tax requirement or location for a currently registered business. Tell us the Illinois Business Tax number (IBT no.)

and federal employer identification number (FEIN) currently assigned to this business.

IBT no.:__ __ __ __ __ __ __ __

FEIN: __ __ __ __ __ __ __ __ __

What is the effective date of this update or addition? ________________

Month

Day

Year

Step 3: Identify your business or organization

1

Business’ or organization’s legal name:

______________________________________________________________________________

Corporate, organization, partnership, or owner’s (if sole proprietor) name

2

Doing business as (DBA) or trade name (if different from above):__________________________________________________________

3

Address of your corporate/home office or your principal Illinois business address. The address where you can be contacted.

__________________________________________________________________________________________________

Street address

Apartment or suite number

__________________________________________________________________________________________________

City

State

ZIP

____________________

_____

____________________

___________________________

Daytime phone (include area code)

Extension

Fax (include area code)

E-mail address

❍

❍

4

Did you buy this business from someone?

yes

no

If yes, write the previous business’ name and IBT no.

____________________________________________________________________________

__ __ __ ____ __ __ __

Previous business’ name

Previous business’ IBT#

5

Check one to indicate your type of business ownership (using the federal income tax classification).

❍

❍

Sole proprietorship. Is this jointly owned by both husband and wife?

yes

no

Corporation (other than an exempt organization)

Tell us the Illinois Corporate File (charter) number issued by the Illinois Secretary of State:_______________________________

❍

❍

Is this a small business corporation (subchapter S)?

yes

no

If yes, tell us how many shareholders. __________

Partnership. Write the number of general partners.________________

Trust or estate

Exempt organization

Governmental agency

Page 1 of 4

(REG-1 N-1/00)

1

1 2

2 3

3 4

4