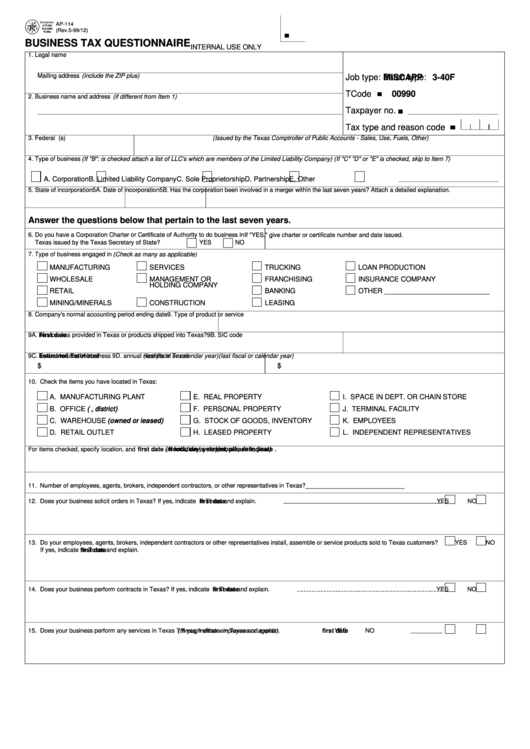

AP-114

(Rev.5-99/12)

BUSINESS TAX QUESTIONNAIRE

INTERNAL USE ONLY

1. Legal name

Mailing address

(include the ZIP plus)

Job type:

MISCAPP

Batch type:

3-40F

TCode

00990

2. Business name and address

(if different from Item 1)

Taxpayer no.

Tax type and reason code

3. Federal E.I. number

Texas tax permit number(s)

(Issued by the Texas Comptroller of Public Accounts - Sales, Use, Fuels, Other)

4. Type of business

(If "B": is checked attach a list of LLC's which are members of the Limited Liability Company) (If "C" "D" or "E" is checked, skip to Item 7)

A. Corporation

B. Limited Liability Company

C. Sole Proprietorship

D. Partnership

E. Other

5. State of incorporation

5A. Date of incorporation

5B. Has the corporation been involved in a merger within the last seven years? Attach a detailed explanation.

Answer the questions below that pertain to the last seven years.

6. Do you have a Corporation Charter or Certificate of Authority to do business in

If "YES," give charter or certificate number and date issued.

Texas issued by the Texas Secretary of State?

YES

NO

7. Type of business engaged in

(Check as many as applicable)

MANUFACTURING

SERVICES

TRUCKING

LOAN PRODUCTION

WHOLESALE

MANAGEMENT OR

FRANCHISING

INSURANCE COMPANY

HOLDING COMPANY

RETAIL

BANKING

OTHER ___________________________

MINING/MINERALS

CONSTRUCTION

LEASING

8. Company's normal accounting period ending date

9. Type of product or service

9A.

First date

service was provided in Texas or products shipped into Texas?

9B. SIC code

9C.

Estimated

annual volume of business

(last fiscal or calendar year)

9D.

Estimated

annual receipts in Texas

(last fiscal or calendar year)

$

$

10. Check the items you have located in Texas:

A. MANUFACTURING PLANT

E. REAL PROPERTY

I. SPACE IN DEPT. OR CHAIN STORE

B. OFFICE

(e.g., district)

F. PERSONAL PROPERTY

J. TERMINAL FACILITY

C. WAREHOUSE

(owned or leased)

G. STOCK OF GOODS, INVENTORY

K. EMPLOYEES

D. RETAIL OUTLET

H. LEASED PROPERTY

L. INDEPENDENT REPRESENTATIVES

For items checked, specify location, and

first date

(month, day, year)

. If location is closed, please indicate

(month, date, year)

.

11. Number of employees, agents, brokers, independent contractors, or other representatives in Texas?_____________________________

12. Does your business solicit orders in Texas? If yes, indicate

first date

in Texas and explain.

YES

NO

13. Do your employees, agents, brokers, independent contractors or other representatives install, assemble or service products sold to Texas customers?

YES

NO

If yes, indicate

first date

in Texas and explain.

14. Does your business perform contracts in Texas? If yes, indicate

first date

in Texas and explain.

YES

NO

15. Does your business perform any services in Texas

(through either employees or agents)

? If yes, indicate

first date

in Texas and explain.

YES

NO

1

1 2

2