Application For Business Tax Exemption For Disabled War Veterans Form - Palm Beach County Ordiance 72-7

ADVERTISEMENT

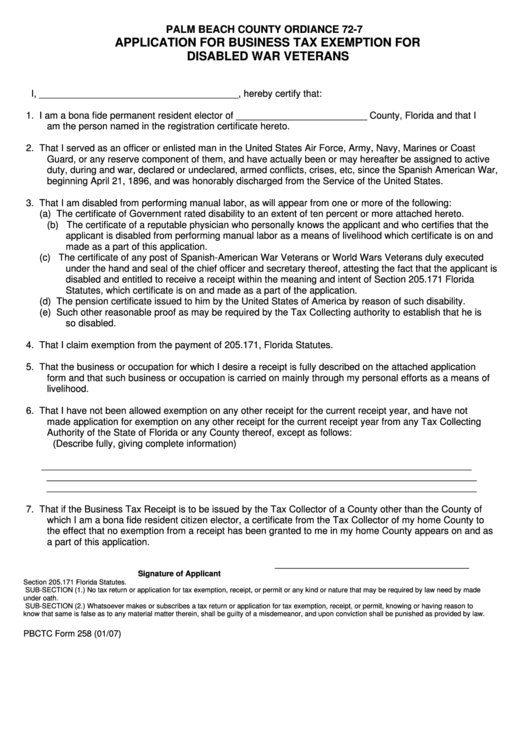

PALM BEACH COUNTY ORDIANCE 72-7

APPLICATION FOR BUSINESS TAX EXEMPTION FOR

DISABLED WAR VETERANS

I, ______________________________________, hereby certify that:

1. I am a bona fide permanent resident elector of _________________________ County, Florida and that I

am the person named in the registration certificate hereto.

2. That I served as an officer or enlisted man in the United States Air Force, Army, Navy, Marines or Coast

Guard, or any reserve component of them, and have actually been or may hereafter be assigned to active

duty, during and war, declared or undeclared, armed conflicts, crises, etc, since the Spanish American War,

beginning April 21, 1896, and was honorably discharged from the Service of the United States.

3. That I am disabled from performing manual labor, as will appear from one or more of the following:

(a) The certificate of Government rated disability to an extent of ten percent or more attached hereto.

(b) The certificate of a reputable physician who personally knows the applicant and who certifies that the

applicant is disabled from performing manual labor as a means of livelihood which certificate is on and

made as a part of this application.

(c) The certificate of any post of Spanish-American War Veterans or World Wars Veterans duly executed

under the hand and seal of the chief officer and secretary thereof, attesting the fact that the applicant is

disabled and entitled to receive a receipt within the meaning and intent of Section 205.171 Florida

Statutes, which certificate is on and made as a part of the application.

(d) The pension certificate issued to him by the United States of America by reason of such disability.

(e) Such other reasonable proof as may be required by the Tax Collecting authority to establish that he is

so disabled.

4. That I claim exemption from the payment of 205.171, Florida Statutes.

5. That the business or occupation for which I desire a receipt is fully described on the attached application

form and that such business or occupation is carried on mainly through my personal efforts as a means of

livelihood.

6. That I have not been allowed exemption on any other receipt for the current receipt year, and have not

made application for exemption on any other receipt for the current receipt year from any Tax Collecting

Authority of the State of Florida or any County thereof, except as follows:

(Describe fully, giving complete information)

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

7. That if the Business Tax Receipt is to be issued by the Tax Collector of a County other than the County of

which I am a bona fide resident citizen elector, a certificate from the Tax Collector of my home County to

the effect that no exemption from a receipt has been granted to me in my home County appears on and as

a part of this application.

_____________________________________

Signature of Applicant

Section 205.171 Florida Statutes.

SUB-SECTION (1.) No tax return or application for tax exemption, receipt, or permit or any kind or nature that may be required by law need by made

under oath.

SUB-SECTION (2.) Whatsoever makes or subscribes a tax return or application for tax exemption, receipt, or permit, knowing or having reason to

know that same is false as to any material matter therein, shall be guilty of a misdemeanor, and upon conviction shall be punished as provided by law.

PBCTC Form 258 (01/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2