Transaction Privilege (Sales) And Use Tax Return With Step By Step Instructions - City Of Chandler Page 4

ADVERTISEMENT

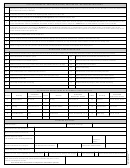

Appendix A

Chandler Business Class and Deduction Codes

Business Class Code

Deductions

Deduction Codes Allowed for Class

Class

Rate

Code

Activity Description

Description

1

1.50%

52

Transportation

52, 64, 81

Discounts & Refunds

4

2.75%

54

Utilities

52, 54, 64, 65, 81

Sales for Resale

5

2.75%

Telecommunications

52, 54, 64, 66, 81

55

Out-of-State Sales

9

1.50%

56

Publishing

52, 54, 55, 64, 65, 69, 81

50% Retail Sales to US Gov't.

10

1.50%

57

Printing

52, 54, 55, 64, 65, 74, 81

100% Mfg. Sales to US Gov't.

11

1.80%

Restaurants and Bars

52, 54, 64, 74, 75, 81

58

Prescriptions/Prosthetics

12

1.50%

59

Amusements

52, 64, 81

Gasoline & Use Fuel

13

1.50%

62

Real Property Rentals

52, 54, 64, 75, 81

Out-of-City Contracting

Retail Service Labor

52, 54, 55, 58, 63, 64, 65, 73, 74,

63

14

1.50%

Personal Property Rentals

75, 81, 83

64

Sales Tax Collected/Factored

15

1.50%

65

Construction Contracting

52, 62, 64, 70, 71, 73, 75, 81

Qualifying Healthcare Sales

16

1.50%

66

Manufactured Buildings

52, 64, 75, 81

Interstate Telecommunications

52, 54, 55, 56, 57, 58, 59, 63, 64,

69

National Advertising

17

1.50%

Retail Sales

65, 73, 74, 75, 79, 81, 82, 83

70

35% Standard Contracting

18

1.50%

71

Advertising

52, 64, 69, 81

Exempt Subcontracting

25

4.40%

73

Hotel/Motel < 31 Days

52, 64, 75, 81

Exempt Capital Equipment

26

1.50%

Hotel/Motel > 30 Days

52, 64, 75, 81

74

Freight Out/Delivery

40

$0.023

75

Jet Fuel Sales - Per Gallon

52, 54, 56, 64, 65, 74, 75, 81

Other Allowed (Must Describe)

79

Food Stamp/WIC Purchases

81

Bad Debts

49

$0.023

82

Jet Fuel - Use Tax - Per Gal.

(None)

Trade-In Allowances

99

1.50%

83

Use Tax

(None)

Mining Supplies

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4