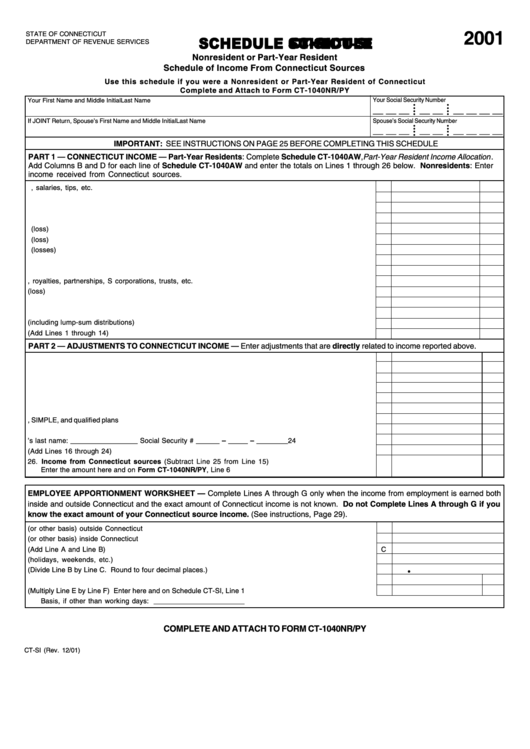

Schedule Ct-Si - Nonresident Or Part-Year Resident Schedule Of Income From Connecticut Sources - 2001

ADVERTISEMENT

STATE OF CONNECTICUT

2001

SCHEDULE

SCHEDULE

CT-SI

CT-SI

SCHEDULE

SCHEDULE CT-SI

SCHEDULE

CT-SI

CT-SI

DEPARTMENT OF REVENUE SERVICES

Nonresident or Part-Year Resident

Schedule of Income From Connecticut Sources

Use this schedule if you were a Nonresident or Part-Year Resident of Connecticut

Complete and Attach to Form CT-1040NR/PY

Your Social Security Number

Your First Name and Middle Initial

Last Name

• •

• •

__ __ __ __ __ __ __ __ __

• •

• •

Spouse’s Social Security Number

If JOINT Return, Spouse’s First Name and Middle Initial

Last Name

• •

• •

__ __ __ __ __ __ __ __ __

• •

• •

IMPORTANT: SEE INSTRUCTIONS ON PAGE 25 BEFORE COMPLETING THIS SCHEDULE

PART 1 — CONNECTICUT INCOME — Part-Year Residents: Complete Schedule CT-1040AW, Part-Year Resident Income Allocation .

Add Columns B and D for each line of Schedule CT-1040AW and enter the totals on Lines 1 through 26 below. Nonresidents: Enter

income received from Connecticut sources.

1. Wages, salaries, tips, etc. ..................................................................................................................................

1

2. Taxable interest ...................................................................................................................................................

2

3. Ordinary dividends ..............................................................................................................................................

3

4. Alimony received .................................................................................................................................................

4

5. Business income or (loss) ..................................................................................................................................

5

6. Capital gain or (loss) ...........................................................................................................................................

6

7. Other gains or (losses) .......................................................................................................................................

7

8. Taxable amount of IRA distributions ...................................................................................................................

8

9. Taxable amount of pensions and annuities ........................................................................................................

9

10. Rental real estate, royalties, partnerships, S corporations, trusts, etc. .......................................................... 10

11. Farm income or (loss) ......................................................................................................................................... 11

12. Unemployment compensation ............................................................................................................................. 12

13. Taxable amount of social security benefits ....................................................................................................... 13

14. Other income (including lump-sum distributions) ............................................................................................... 14

15. Gross income from Connecticut sources (Add Lines 1 through 14) ............................................................... 15

PART 2 — ADJUSTMENTS TO CONNECTICUT INCOME — Enter adjustments that are directly related to income reported above.

16. IRA deduction ....................................................................................................................................................... 16

17. Student loan interest deduction .......................................................................................................................... 17

18. Archer MSA deduction ........................................................................................................................................ 18

19. Moving expenses ................................................................................................................................................ 19

20. One-half of self-employment tax ........................................................................................................................ 20

21. Self-employed health insurance deduction ........................................................................................................ 21

22. Self-employed SEP, SIMPLE, and qualified plans ............................................................................................... 22

23. Penalty on early withdrawal of savings ............................................................................................................ 23

24. Alimony paid. Recipient’s last name: _________________ Social Security # ______ – _____ – ________ 24

25. Total adjustments (Add Lines 16 through 24) .................................................................................................... 25

26. Income from Connecticut sources (Subtract Line 25 from Line 15)

Enter the amount here and on Form CT-1040NR/PY, Line 6 ........................................................................... 26

EMPLOYEE APPORTIONMENT WORKSHEET — Complete Lines A through G only when the income from employment is earned both

inside and outside Connecticut and the exact amount of Connecticut income is not known. Do not Complete Lines A through G if you

know the exact amount of your Connecticut source income. (See instructions, Page 29).

A. Working days (or other basis) outside Connecticut .......................................................................................... A

B. Working days (or other basis) inside Connecticut ............................................................................................

B

C. Total working days (Add Line A and Line B) .....................................................................................................

C

D. Nonworking days (holidays, weekends, etc.) ..................................................................................................

D

.

E.

Connecticut ratio (Divide Line B by Line C. Round to four decimal places.) ..................................................

E

F.

Total income being apportioned ..........................................................................................................................

F

G. Connecticut income (Multiply Line E by Line F) Enter here and on Schedule CT-SI, Line 1 ...........................

G

Basis, if other than working days: _______________________

COMPLETE AND ATTACH TO FORM CT-1040NR/PY

CT-SI (Rev. 12/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1