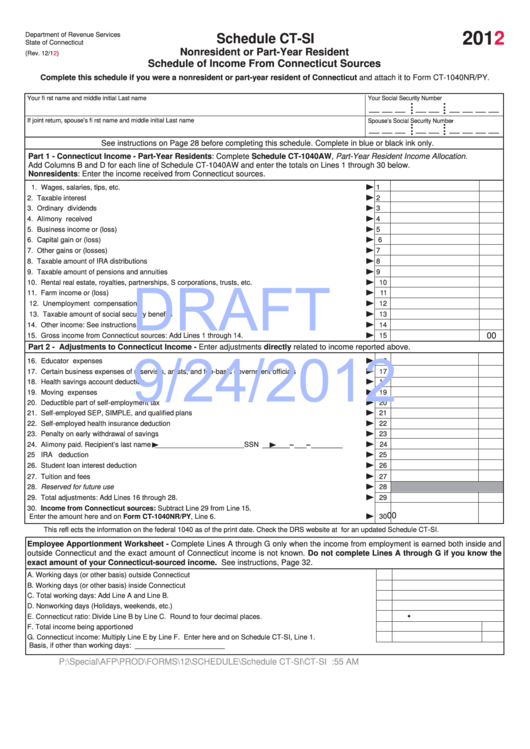

Schedule Ct-Si Draft - Nonresident Or Part-Year Resident Schedule Of Income From Connecticut Sources - 2012

ADVERTISEMENT

2012

Department of Revenue Services

Schedule CT-SI

State of Connecticut

Nonresident or Part-Year Resident

(Rev. 12/12)

Schedule of Income From Connecticut Sources

Complete this schedule if you were a nonresident or part-year resident of Connecticut and attach it to Form CT-1040NR/PY.

Your fi rst name and middle initial

Last name

Your Social Security Number

• •

• •

__ __ __ __ __ __ __ __ __

•

•

•

•

If joint return, spouse’s fi rst name and middle initial

Last name

Spouse’s Social Security Number

• •

• •

__ __ __ __ __ __ __ __ __

•

•

•

•

See instructions on Page 28 before completing this schedule. Complete in blue or black ink only.

Part 1 - Connecticut Income - Part-Year Residents: Complete Schedule CT-1040AW, Part-Year Resident Income Allocation.

Add Columns B and D for each line of Schedule CT-1040AW and enter the totals on Lines 1 through 30 below.

Nonresidents: Enter the income received from Connecticut sources.

1. Wages, salaries, tips, etc. ............................................................................................................................... 1

2. Taxable interest .............................................................................................................................................. 2

3. Ordinary dividends .......................................................................................................................................... 3

4. Alimony received ............................................................................................................................................. 4

5. Business income or (loss) ............................................................................................................................... 5

6. Capital gain or (loss) ....................................................................................................................................... 6

7. Other gains or (losses) .................................................................................................................................... 7

8. Taxable amount of IRA distributions ................................................................................................................ 8

9. Taxable amount of pensions and annuities ..................................................................................................... 9

DRAFT

10. Rental real estate, royalties, partnerships, S corporations, trusts, etc. ........................................................... 10

11. Farm income or (loss) ..................................................................................................................................... 11

12. Unemployment compensation ......................................................................................................................... 12

13. Taxable amount of social security benefi ts ...................................................................................................... 13

14. Other income: See instructions. ..................................................................................................................... 14

00

15. Gross income from Connecticut sources: Add Lines 1 through 14. ................................................................ 15

9/24/2012

Part 2 - Adjustments to Connecticut Income - Enter adjustments directly related to income reported above.

16. Educator expenses .......................................................................................................................................... 16

17. Certain business expenses of reservists, artists, and fee-basis government offi cials ..................................... 17

18. Health savings account deduction ................................................................................................................... 18

19. Moving expenses ............................................................................................................................................ 19

20. Deductible part of self-employment tax ........................................................................................................... 20

21. Self-employed SEP, SIMPLE, and qualifi ed plans .......................................................................................... 21

22. Self-employed health insurance deduction ..................................................................................................... 22

23. Penalty on early withdrawal of savings ........................................................................................................... 23

_______ – ___ – ________ 24

24. Alimony paid. Recipient’s last name

_______________________ SSN

25 IRA deduction .................................................................................................................................................. 25

26. Student loan interest deduction ....................................................................................................................... 26

27. Tuition and fees ............................................................................................................................................... 27

28. Reserved for future use ................................................................................................................................... 28

29. Total adjustments: Add Lines 16 through 28. ................................................................................................. 29

30. Income from Connecticut sources: Subtract Line 29 from Line 15.

00

Enter the amount here and on Form CT-1040NR/PY, Line 6. ....................................................................... 30

This refl ects the information on the federal 1040 as of the print date. Check the DRS website at for an updated Schedule CT-SI.

Employee Apportionment Worksheet - Complete Lines A through G only when the income from employment is earned both inside and

outside Connecticut and the exact amount of Connecticut income is not known. Do not complete Lines A through G if you know the

exact amount of your Connecticut-sourced income. See instructions, Page 32.

A. Working days (or other basis) outside Connecticut .............................................................................................. A

B. Working days (or other basis) inside Connecticut ................................................................................................ B

C. Total working days: Add Line A and Line B. ......................................................................................................... C

.

D. Nonworking days (Holidays, weekends, etc.) ....................................................................................................... D

E. Connecticut ratio: Divide Line B by Line C. Round to four decimal places. ....................................................... E

F.

Total income being apportioned ........................................................................................................................... F

G. Connecticut income: Multiply Line E by Line F. Enter here and on Schedule CT-SI, Line 1. ............................. G

Basis, if other than working days: _______________________

P:\Special\AFP\PROD\FORMS\12\SCHEDULE\Schedule CT-SI\CT-SI 20120731.indd20120731

10:55 AM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1