Form 01-135 - Vendor'S Request For Refund And Assignment Of Right To Refund

ADVERTISEMENT

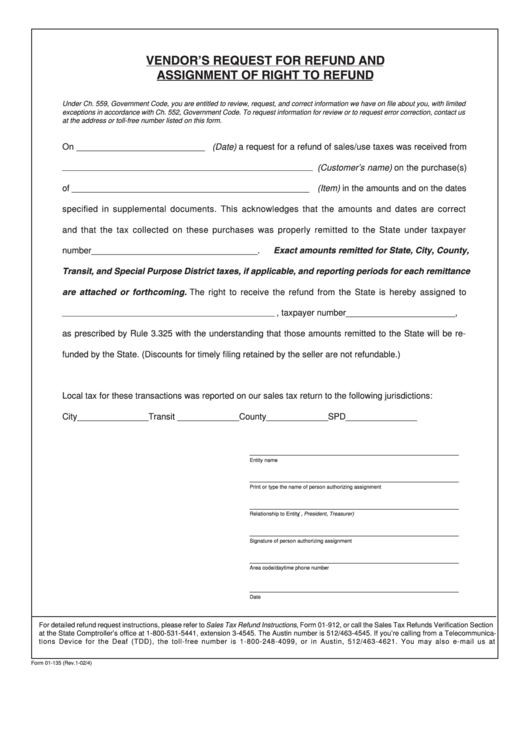

VENDOR’S REQUEST FOR REFUND AND

ASSIGNMENT OF RIGHT TO REFUND

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited

exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us

at the address or toll-free number listed on this form.

On ___________________________ (Date) a request for a refund of sales/use taxes was received from

(Customer’s name) on the purchase(s)

of __________________________________________________ (Item) in the amounts and on the dates

specified in supplemental documents. This acknowledges that the amounts and dates are correct

and that the tax collected on these purchases was properly remitted to the State under taxpayer

number ___________________________________ . Exact amounts remitted for State, City, County,

Transit, and Special Purpose District taxes, if applicable, and reporting periods for each remittance

are attached or forthcoming. The right to receive the refund from the State is hereby assigned to

, taxpayer number _______________________ ,

as prescribed by Rule 3.325 with the understanding that those amounts remitted to the State will be re-

funded by the State. (Discounts for timely filing retained by the seller are not refundable.)

Local tax for these transactions was reported on our sales tax return to the following jurisdictions:

City _______________

Transit _____________

County _____________

SPD _______________

____________________________________________

Entity name

____________________________________________

Print or type the name of person authorizing assignment

____________________________________________

Relationship to Entity (i.e., President, Treasurer)

____________________________________________

Signature of person authorizing assignment

____________________________________________

Area code/daytime phone number

____________________________________________

Date

For detailed refund request instructions, please refer to Sales Tax Refund Instructions , Form 01-912, or call the Sales Tax Refunds Verification Section

at the State Comptroller’s office at 1-800-531-5441, extension 3-4545. The Austin number is 512/463-4545. If you’re calling from a Telecommunica-

tions Device for the Deaf (TDD), the toll-free number is 1-800-248-4099, or in Austin, 512/463-4621. You may also e-mail us at

refundreq.revacct@cpa.state.tx.us.

Form 01-135 (Rev.1-02/4)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1