Form Il-1363-X - Amended Application For Form Il-1363 Benefits

ADVERTISEMENT

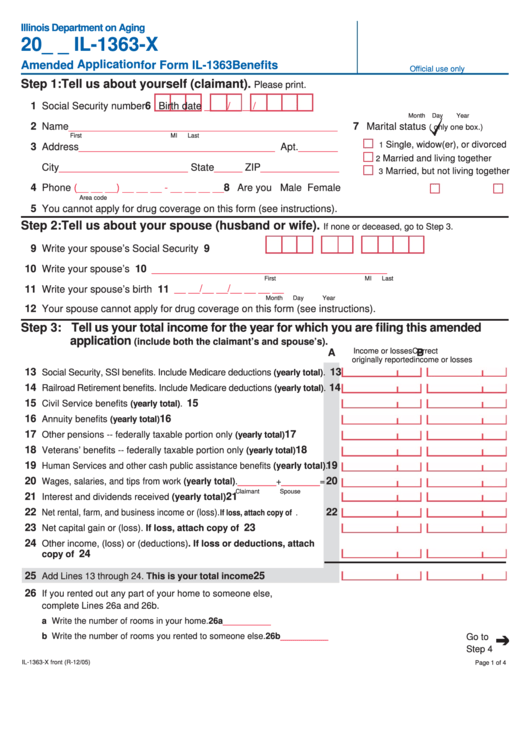

Illinois Department on Aging

20_ _ IL-1363-X

Amended Application for Form IL-1363 Benefits

Official use only

Step 1: Tell us about yourself (claimant).

Please print.

1 Social Security number

6 Birth date

__ __/__ __/__ __ __ __

Month

Day

Year

2

7 Marital status

Name________________________________________________

(

only one box.)

First

MI

Last

Single, widow(er), or divorced

1

3

Address___________________________________ Apt._______

Married and living together

2

City_______________________ State_____ ZIP______________

Married, but not living together

3

4 Phone

8 Are you Male

(__ __ __) __ __ __ - __ __ __ __

Female

Area code

5 You cannot apply for drug coverage on this form (see instructions).

Step 2: Tell us about your spouse (husband or wife).

If none or deceased, go to Step 3.

9 Write your spouse’s Social Security number. .... 9

10 Write your spouse’s name. .............................. 10

__________________________________________

First

MI

Last

__ __/__ __/__ __ __ __

11 Write your spouse’s birth date. ........................ 11

Month

Day

Year

12 Your spouse cannot apply for drug coverage on this form (see instructions).

Step 3: Tell us your total income for the year for which you are filing this amended

application

(include both the claimant’s and spouse’s).

Income or losses

Correct

A

B

originally reported

income or losses

13

13

Social Security, SSI benefits. Include Medicare deductions (yearly total) .

14

14

Railroad Retirement benefits. Include Medicare deductions (yearly total).

15

15

Civil Service benefits (yearly total). ..........................................................

16

16

Annuity benefits (yearly total). ..................................................................

17

17

Other pensions -- federally taxable portion only (yearly total). ...............

18

18

Veterans’ benefits -- federally taxable portion only (yearly total). ...........

19

19

Human Services and other cash public assistance benefits (yearly total).

20

20

Wages, salaries, and tips from work (yearly total).________+________=

Claimant

Spouse

21

21

Interest and dividends received (yearly total). ......................................

22

22

Net rental, farm, and business income or (loss).

If loss, attach copy of U.S. 1040.

23

23

Net capital gain or (loss). If loss, attach copy of U.S. 1040. ................

24

Other income, (loss) or (deductions). If loss or deductions, attach

24

copy of U.S. 1040. .................................................................................

25

25

Add Lines 13 through 24. This is your total income. ...........................

26

If you rented out any part of your home to someone else,

complete Lines 26a and 26b.

a Write the number of rooms in your home.

26a__________

b Write the number of rooms you rented to someone else.

26b__________

Go to

Step 4

IL-1363-X front (R-12/05)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2