Form Il-1363-X - Amended Application For Circuit Breaker And Pharmaceutical Assistance - Instructions

ADVERTISEMENT

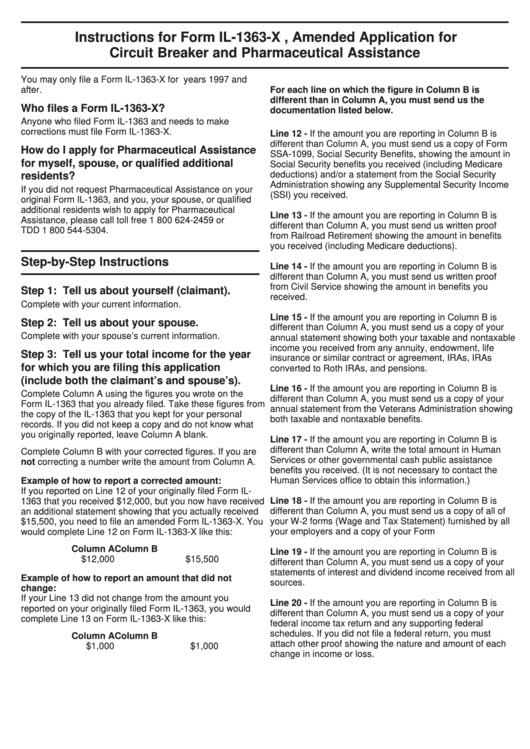

Instructions for Form IL-1363-X , Amended Application for

Circuit Breaker and Pharmaceutical Assistance

You may only file a Form IL-1363-X for years 1997 and

after.

For each line on which the figure in Column B is

different than in Column A, you must send us the

Who files a Form IL-1363-X?

documentation listed below.

Anyone who filed Form IL-1363 and needs to make

corrections must file Form IL-1363-X.

Line 12 - If the amount you are reporting in Column B is

different than Column A, you must send us a copy of Form

How do I apply for Pharmaceutical Assistance

SSA-1099, Social Security Benefits, showing the amount in

for myself, spouse, or qualified additional

Social Security benefits you received (including Medicare

deductions) and/or a statement from the Social Security

residents?

Administration showing any Supplemental Security Income

If you did not request Pharmaceutical Assistance on your

(SSI) you received.

original Form IL-1363, and you, your spouse, or qualified

additional residents wish to apply for Pharmaceutical

Line 13 - If the amount you are reporting in Column B is

Assistance, please call toll free 1 800 624-2459 or

different than Column A, you must send us written proof

TDD 1 800 544-5304.

from Railroad Retirement showing the amount in benefits

you received (including Medicare deductions).

Step-by-Step Instructions

Line 14 - If the amount you are reporting in Column B is

different than Column A, you must send us written proof

from Civil Service showing the amount in benefits you

Step 1: Tell us about yourself (claimant).

received.

Complete with your current information.

Line 15 - If the amount you are reporting in Column B is

Step 2: Tell us about your spouse.

different than Column A, you must send us a copy of your

Complete with your spouse’s current information.

annual statement showing both your taxable and nontaxable

income you received from any annuity, endowment, life

Step 3: Tell us your total income for the year

insurance or similar contract or agreement, IRAs, IRAs

for which you are filing this application

converted to Roth IRAs, and pensions.

(include both the claimant’s and spouse’s).

Line 16 - If the amount you are reporting in Column B is

Complete Column A using the figures you wrote on the

different than Column A, you must send us a copy of your

Form IL-1363 that you already filed. Take these figures from

annual statement from the Veterans Administration showing

the copy of the IL-1363 that you kept for your personal

both taxable and nontaxable benefits.

records. If you did not keep a copy and do not know what

you originally reported, leave Column A blank.

Line 17 - If the amount you are reporting in Column B is

different than Column A, write the total amount in Human

Complete Column B with your corrected figures. If you are

Services or other governmental cash public assistance

not correcting a number write the amount from Column A.

benefits you received. (It is not necessary to contact the

Human Services office to obtain this information.)

Example of how to report a corrected amount:

If you reported on Line 12 of your originally filed Form IL-

1363 that you received $12,000, but you now have received

Line 18 - If the amount you are reporting in Column B is

different than Column A, you must send us a copy of all of

an additional statement showing that you actually received

$15,500, you need to file an amended Form IL-1363-X. You

your W-2 forms (Wage and Tax Statement) furnished by all

your employers and a copy of your Form U.S. 1040.

would complete Line 12 on Form IL-1363-X like this:

Column A

Column B

Line 19 - If the amount you are reporting in Column B is

$12,000

$15,500

different than Column A, you must send us a copy of your

statements of interest and dividend income received from all

Example of how to report an amount that did not

sources.

change:

If your Line 13 did not change from the amount you

Line 20 - If the amount you are reporting in Column B is

reported on your originally filed Form IL-1363, you would

different than Column A, you must send us a copy of your

complete Line 13 on Form IL-1363-X like this:

federal income tax return and any supporting federal

schedules. If you did not file a federal return, you must

Column A

Column B

attach other proof showing the nature and amount of each

$1,000

$1,000

change in income or loss.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2