Form Rp-477-A - Application For Real Property Tax Exemption For Air Pollution Control Facilities Page 2

ADVERTISEMENT

RP-477-a (7/02)

2

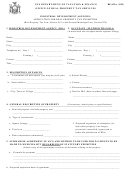

CERTIFICATION

I, ________________________, hereby certify that the information on this application and any accompanying

papers constitutes a true statement of facts.

_____________

_______________________________________________

Date

Signature of owner(s) or authorized representative

GENERAL INFORMATION AND FILING REQUIREMENTS

1. Place of filing application

Application for exemption from county, city, town, school district and village taxes, should be filed with

the city, town or village assessor who prepares the assessment roll used in levying county, city, or town, village and

school district taxes. If a facility is located in a village which assesses, a copy of the application must also be

submitted to the appropriate village assessor. In Nassau and Tompkins County, application for exemption should

be filed with the County Assessors.

2. Time of filing application

The application must be filed on or before the taxable status date of the county, city, town, or village whose

taxes are involved. Since this date differs among municipalities, the appropriate county, city, or town and village

assessor’s office should be consulted.

3. Certificate of compliance

The facilities are not entitled to an exemption unless a certificate of compliance has been issued by the

Department of Environmental Conservation pursuant to Section 19-0307 of the Environmental Conservation Law.

A copy of this certificate must be submitted with the application. Where only a temporary certificate has been

issued for facilities which are incomplete on the appropriate taxable status date, the exemption applies only to taxes

levied with respect to that taxable status date. Facilities which are exempt on the basis of a three-year certificate of

compliance continue to be exempt for such period unless the certificate is revoked by the Department of

Environmental Conservation. When a temporary, renewal or three-year certificate of compliance for the facility is

issued by the Department of Environmental Conservation, a new application must be filed with the appropriate

assessor.

4. Non-exempt facilities

(a) Facilities which rely for their efficiency on dilution, dispersion or assimilation of air contaminants in the

ambient air are not entitled to exemption (for example, stack additions).

(b) Facilities which are installed for the primary purpose of salvaging materials which are usable in the

manufacturing process or are marketable are not entitled to exemption.

SPACE BELOW FOR ASSESSOR’S USE

Date application filed _______________________

Applicable taxable status date ____________________

Certificate of compliance No. ____________________

Submitted:

Permanent

Three-year

Assessed valuation of exemption granted $ __________________________

Exemption applies to taxes levied by or for: _________________________________________________________

(Name of county, city, town, village and school district)

Application approved

Application disapproved

____________________

_____________________________________________

Date

Assessor’s signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2