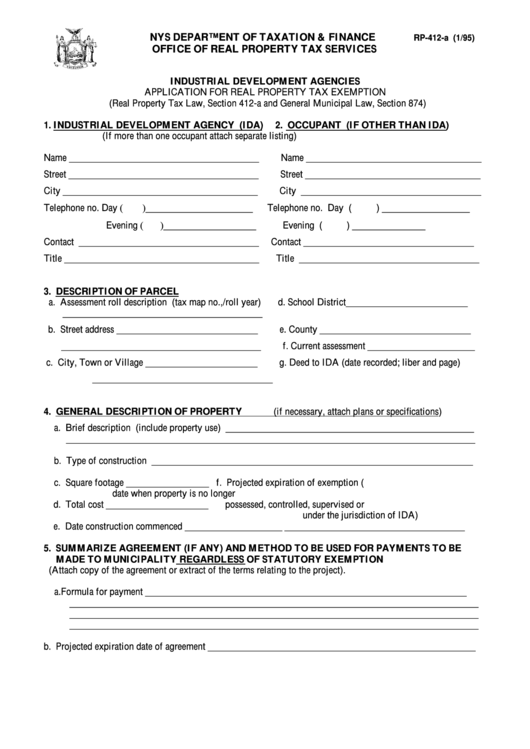

NYS DEPARTMENT OF TAXATION & FINANCE

RP-412-a (1/95)

OFFICE OF REAL PROPERTY TAX SERVICES

INDUSTRIAL DEVELOPMENT AGENCIES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION

(Real Property Tax Law, Section 412-a and General Municipal Law, Section 874)

1. INDUSTRIAL DEVELOPMENT AGENCY (IDA)

2. OCCUPANT (IF OTHER THAN IDA)

(If more than one occupant attach separate listing)

Name _______________________________________

Name ____________________________________

Street _______________________________________

Street ____________________________________

City ________________________________________

City _____________________________________

Telephone no. Day (

)______________________

Telephone no. Day (

) __________________

Evening (

)___________________

Evening (

) _______________

Contact _____________________________________

Contact ___________________________________

Title ________________________________________

Title _____________________________________

3. DESCRIPTION OF PARCEL

a. Assessment roll description (tax map no.,/roll year)

d. School District_________________________

_________________________________________

b. Street address _____________________________

e. County _______________________________

_________________________________________

f. Current assessment ______________________

c. City, Town or Village _______________________

g. Deed to IDA (date recorded; liber and page)

_____________________________________

4. GENERAL DESCRIPTION OF PROPERTY

(if necessary, attach plans or specifications)

a. Brief description (include property use) ___________________________________________________

____________________________________________________________________________________

b. Type of construction __________________________________________________________________

c. Square footage _________________

f. Projected expiration of exemption (i.e.

date when property is no longer

d. Total cost _____________________

possessed, controlled, supervised or

under the jurisdiction of IDA)

e. Date construction commenced ____________________

_____________________________________

5. SUMMARIZE AGREEMENT (IF ANY) AND METHOD TO BE USED FOR PAYMENTS TO BE

MADE TO MUNICIPALITY REGARDLESS OF STATUTORY EXEMPTION

(Attach copy of the agreement or extract of the terms relating to the project).

a. Formula for payment __________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

____________________________________________________________________________________

b. Projected expiration date of agreement _______________________________________________________

1

1 2

2