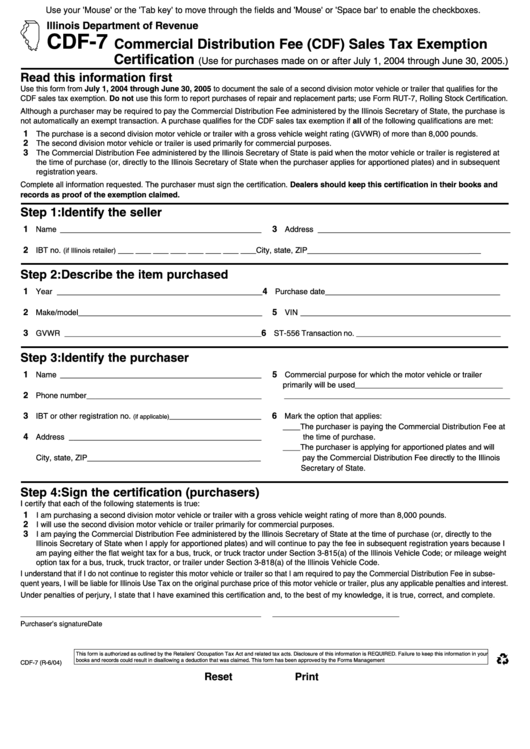

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

CDF-7

Commercial Distribution Fee (CDF) Sales Tax Exemption

Certification

(Use for purchases made on or after July 1, 2004 through June 30, 2005.)

Read this information first

Use this form from July 1, 2004 through June 30, 2005 to document the sale of a second division motor vehicle or trailer that qualifies for the

CDF sales tax exemption. Do not use this form to report purchases of repair and replacement parts; use Form RUT-7, Rolling Stock Certification.

Although a purchaser may be required to pay the Commercial Distribution Fee administered by the Illinois Secretary of State, the purchase is

not automatically an exempt transaction. A purchase qualifies for the CDF sales tax exemption if all of the following qualifications are met:

1

The purchase is a second division motor vehicle or trailer with a gross vehicle weight rating (GVWR) of more than 8,000 pounds.

2

The second division motor vehicle or trailer is used primarily for commercial purposes.

3

The Commercial Distribution Fee administered by the Illinois Secretary of State is paid when the motor vehicle or trailer is registered at

the time of purchase (or, directly to the Illinois Secretary of State when the purchaser applies for apportioned plates) and in subsequent

registration years.

Complete all information requested. The purchaser must sign the certification. Dealers should keep this certification in their books and

records as proof of the exemption claimed.

Step 1: Identify the seller

1

3

Name ______________________________________________

Address ____________________________________________

2

IBT no.

City, state, ZIP _____________________________________

(if Illinois retailer) ____ ____ ____ ____ ____ ____ ____ ____

___

Step 2: Describe the item purchased

1

4

Year _______________________________________________

Purchase date________________________________________

2

5

Make/model__________________________________________

VIN ________________________________________________

3

6

GVWR _____________________________________________

ST-556 Transaction no. _________________________________

Step 3: Identify the purchaser

1

5

Name ______________________________________________

Commercial purpose for which the motor vehicle or trailer

primarily will be used

______________________________________

2

Phone number________________________________________

__________________________________________________________

3

6

IBT or other registration no.

_____________________

Mark the option that applies:

(if applicable)

____ The purchaser is paying the Commercial Distribution Fee at

4

Address ____________________________________________

the time of purchase.

____ The purchaser is applying for apportioned plates and will

City, state, ZIP _____________________________________

pay the Commercial Distribution Fee directly to the Illinois

___

Secretary of State.

Step 4: Sign the certification (purchasers)

I certify that each of the following statements is true:

1

I am purchasing a second division motor vehicle or trailer with a gross vehicle weight rating of more than 8,000 pounds.

2

I will use the second division motor vehicle or trailer primarily for commercial purposes.

3

I am paying the Commercial Distribution Fee administered by the Illinois Secretary of State at the time of purchase (or, directly to the

Illinois Secretary of State when I apply for apportioned plates) and will continue to pay the fee in subsequent registration years because I

am paying either the flat weight tax for a bus, truck, or truck tractor under Section 3-815(a) of the Illinois Vehicle Code; or mileage weight

option tax for a bus, truck, truck tractor, or trailer under Section 3-818(a) of the Illinois Vehicle Code.

I understand that if I do not continue to register this motor vehicle or trailer so that I am required to pay the Commercial Distribution Fee in subse-

quent years, I will be liable for Illinois Use Tax on the original purchase price of this motor vehicle or trailer, plus any applicable penalties and interest.

Under penalties of perjury, I state that I have examined this certification and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

_____________________________

Purchaser’s signature

Date

This form is authorized as outlined by the Retailers’ Occupation Tax Act and related tax acts. Disclosure of this information is REQUIRED. Failure to keep this information in your

books and records could result in disallowing a deduction that was claimed. This form has been approved by the Forms Management Center.

IL-492-4352

CDF-7 (R-6/04)

Reset

Print

1

1