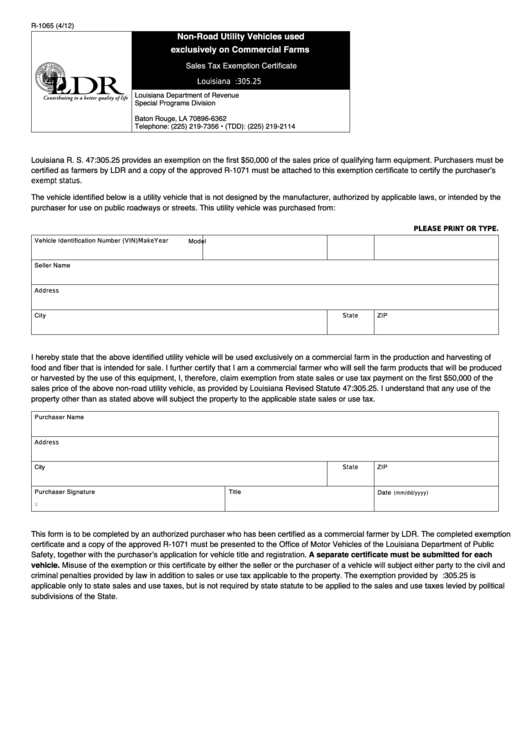

R-1065 (4/12)

Non-Road Utility Vehicles used

exclusively on Commercial Farms

Sales Tax Exemption Certificate

Louisiana R.S. 47:305.25

Louisiana Department of Revenue

Special Programs Division

P.O. Box 66362

Baton Rouge, LA 70896-6362

Telephone: (225) 219-7356 • (TDD): (225) 219-2114

Louisiana R. S. 47:305.25 provides an exemption on the first $50,000 of the sales price of qualifying farm equipment. Purchasers must be

certified as farmers by LDR and a copy of the approved R-1071 must be attached to this exemption certificate to certify the purchaser’s

exempt status.

The vehicle identified below is a utility vehicle that is not designed by the manufacturer, authorized by applicable laws, or intended by the

purchaser for use on public roadways or streets. This utility vehicle was purchased from:

PLEASE PRINT OR TYPE.

Vehicle Identification Number (VIN)

Model

Make

Year

Seller Name

Address

City

ZIP

State

I hereby state that the above identified utility vehicle will be used exclusively on a commercial farm in the production and harvesting of

food and fiber that is intended for sale. I further certify that I am a commercial farmer who will sell the farm products that will be produced

or harvested by the use of this equipment, I, therefore, claim exemption from state sales or use tax payment on the first $50,000 of the

sales price of the above non-road utility vehicle, as provided by Louisiana Revised Statute 47:305.25. I understand that any use of the

property other than as stated above will subject the property to the applicable state sales or use tax.

Purchaser Name

Address

City

ZIP

State

Purchaser Signature

Title

Date

(mm/dd/yyyy)

X

This form is to be completed by an authorized purchaser who has been certified as a commercial farmer by LDR. The completed exemption

certificate and a copy of the approved R-1071 must be presented to the Office of Motor Vehicles of the Louisiana Department of Public

Safety, together with the purchaser’s application for vehicle title and registration. A separate certificate must be submitted for each

vehicle. Misuse of the exemption or this certificate by either the seller or the purchaser of a vehicle will subject either party to the civil and

criminal penalties provided by law in addition to sales or use tax applicable to the property. The exemption provided by R.S. 47:305.25 is

applicable only to state sales and use taxes, but is not required by state statute to be applied to the sales and use taxes levied by political

subdivisions of the State.

1

1