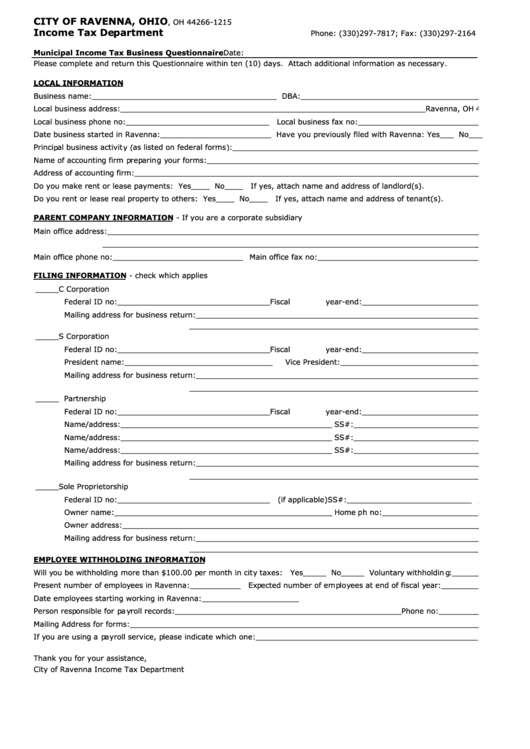

CITY OF RAVENNA, OHIO

P.O. Box 1215 - Ravenna, OH 44266-1215

Income Tax Department

Phone: (330)297-7817; Fax: (330)297-2164

Municipal Income Tax Business Questionnaire

Date:

Please complete and return this Questionnaire within ten (10) days. Attach additional information as necessary.

LOCAL INFORMATION

Business name:________________________________________ DBA:_______________________________________

Local business address:__________________________________________________________________Ravenna, OH 4

Local business phone no:_______________________________

Local business fax no:___________________________

Date business started in Ravenna:________________________ Have you previously filed with Ravenna: Yes___ No___

Principal business activity (as listed on federal forms):______________________________________________________

Name of accounting firm preparing your forms:___________________________________________________________

Address of accounting firm:___________________________________________________________________________

Do you make rent or lease payments: Yes____ No____

If yes, attach name and address of landlord(s).

Do you rent or lease real property to others: Yes____ No____

If yes, attach name and address of tenant(s).

PARENT COMPANY INFORMATION - If you are a corporate subsidiary

Main office address:_________________________________________________________________________________

__________________________________________________________________________________

Main office phone no:_____________________________ Main office fax no:___________________________________

FILING INFORMATION - check which applies

_____ C Corporation

Federal ID no:_________________________________

Fiscal year-end:__________________________

Mailing address for business return:______________________________________________________________

_______________________________________________________________

_____ S Corporation

Federal ID no:_________________________________

Fiscal year-end:__________________________

President name:________________________________

Vice President:______________________________

Mailing address for business return:______________________________________________________________

_______________________________________________________________

_____ Partnership

Federal ID no:_________________________________

Fiscal year-end:__________________________

Name/address:______________________________________________ SS#:____________________________

Name/address:______________________________________________ SS#:____________________________

Name/address:______________________________________________ SS#:____________________________

Mailing address for business return:______________________________________________________________

_______________________________________________________________

_____ Sole Proprietorship

Federal ID no:_________________________________

(if applicable) SS#:____________________________

Owner name:________________________________________________ Home ph no:_____________________

Owner address:______________________________________________________________________________

Mailing address for business return:______________________________________________________________

_______________________________________________________________

EMPLOYEE WITHHOLDING INFORMATION

Will you be withholding more than $100.00 per month in city taxes:

Yes_____ No_____ Voluntary withholding:______

Present number of employees in Ravenna:___________

Expected number of employees at end of fiscal year:_________

Date employees starting working in Ravenna:_____________________

Person responsible for payroll records:_________________________________________________Phone no:_________

Mailing Address for forms:____________________________________________________________________________

If you are using a payroll service, please indicate which one:_________________________________________________

Thank you for your assistance,

City of Ravenna Income Tax Department

1

1