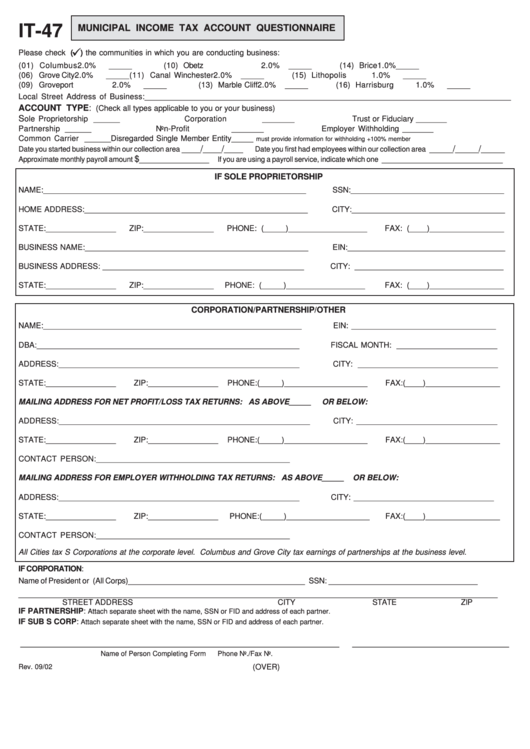

IT-47

MUNICIPAL INCOME TAX ACCOUNT QUESTIONNAIRE

!

Please check ( ) the communities in which you are conducting business:

(01) Columbus

2.0%

_____

(10) Obetz

2.0%

_____

(14) Brice

1.0%

_____

(06) Grove City

2.0%

_____

(11) Canal Winchester

2.0%

_____

(15) Lithopolis

1.0%

_____

(09) Groveport

2.0%

_____

(13) Marble Cliff

2.0%

_____

(16) Harrisburg

1.0%

_____

Local Street Address of Business:_________________________________________________________________________________

ACCOUNT TYPE:

(Check all types applicable to you or your business)

S

ole Proprietorship

______

Corporation

_______

Trust or Fiduciary

_______

Partnership

______

Non-Profit

_______

Employer Withholding

_______

Common Carrier

______

Disregarded Single Member Entity_____

must provide information for withholding +100% member

____/____/____

_____/_____/_____

Date you started business within our collection area

Date you first had employees within our collection area

$_______________

__________________________

Approximate monthly payroll amount

If you are using a payroll service, indicate which one

IF SOLE PROPRIETORSHIP

NAME:____________________________________________________________

SSN:___________________________________

HOME ADDRESS:___________________________________________________

CITY:___________________________________

STATE:________________

ZIP:________________

PHONE: (_____)__________________

FAX: (____)_________________

BUSINESS NAME:___________________________________________________

EIN:____________________________________

BUSINESS ADDRESS: ______________________________________________

CITY: __________________________________

STATE:________________

ZIP:________________

PHONE: (_____)__________________

FAX: (____)_________________

CORPORATION/PARTNERSHIP/OTHER

NAME:___________________________________________________________

EIN: _________________________________

DBA:____________________________________________________________

FISCAL MONTH: _______________________

ADDRESS:_______________________________________________________

CITY: ________________________________

STATE:________________

ZIP:________________

PHONE:(_____)___________________

FAX:(____)_________________

MAILING ADDRESS FOR NET PROFIT/LOSS TAX RETURNS: AS ABOVE_____

OR BELOW:

ADDRESS:_________________________________________________________

CITY: ________________________________

STATE:________________

ZIP:________________

PHONE:(_____)___________________

FAX:(____)_________________

CONTACT PERSON:___________________________________________

MAILING ADDRESS FOR EMPLOYER WITHHOLDING TAX RETURNS: AS ABOVE_____

OR BELOW:

ADDRESS:_______________________________________________________

CITY: ________________________________

STATE:________________

ZIP:________________

PHONE:(_____)___________________

FAX:(____)_________________

CONTACT PERSON:___________________________________________

All Cities tax S Corporations at the corporate level. Columbus and Grove City tax earnings of partnerships at the business level.

IF CORPORATION:

______________________________________

________________________________

Name of President or C.E.O (All Corps)

SSN:

___________________________________________________________________________________________________________

STREET ADDRESS

CITY

STATE

ZIP

IF PARTNERSHIP:

Attach separate sheet with the name, SSN or FID and address of each partner.

IF SUB S CORP:

Attach separate sheet with the name, SSN or FID and address of each partner.

_____________________________________________________________

______________________________

Name of Person Completing Form

Phone No./Fax No.

(OVER)

Rev. 09/02

1

1