Business Tax Questionnaire Form

ADVERTISEMENT

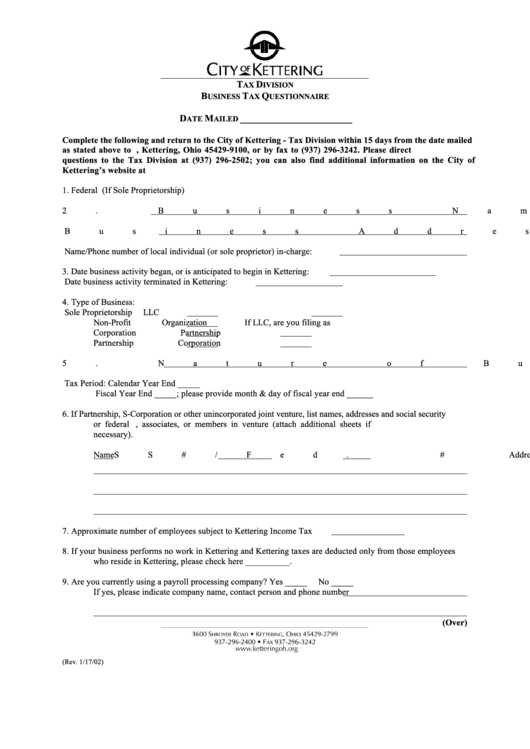

T

D

AX

IVISION

B

T

Q

USINESS

AX

UESTIONNAIRE

D

M

_______________________

ATE

AILED

Complete the following and return to the City of Kettering - Tax Division within 15 days from the date mailed

as stated above to P.O. Box 293100, Kettering, Ohio 45429-9100, or by fax to (937) 296-3242. Please direct

questions to the Tax Division at (937) 296-2502; you can also find additional information on the City of

Kettering’s website at

1.

Federal I.D. Number _________________ Social Security No. _______________ (If Sole Proprietorship)

2.

Business Name:

Business Address:

Name/Phone number of local individual (or sole proprietor) in-charge:

3.

Date business activity began, or is anticipated to begin in Kettering:

Date business activity terminated in Kettering:

4.

Type of Business:

Sole Proprietorship

LLC

Non-Profit Organization

If LLC, are you filing as

Corporation

Partnership

Partnership

Corporation

5.

Nature of Business:

Tax Period: Calendar Year End _____

Fiscal Year End _____; please provide month & day of fiscal year end ______

6.

If Partnership, S-Corporation or other unincorporated joint venture, list names, addresses and social security

or federal I.D. numbers of all partners, associates, or members in venture (attach additional sheets if

necessary).

Name

SS#/Fed. I.D. #

Address

7.

Approximate number of employees subject to Kettering Income Tax

8.

If your business performs no work in Kettering and Kettering taxes are deducted only from those employees

who reside in Kettering, please check here __________.

9.

Are you currently using a payroll processing company? Yes _____

No _____

If yes, please indicate company name, contact person and phone number

(Over)

tx-3001-tj.doc (Rev. 1/17/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2