Form Tpt-1 - Transaction Privilege (Sales) And Use Tax Return Form - City Of Chandler Page 4

ADVERTISEMENT

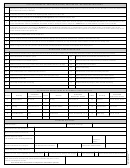

TRANSACTION PRIVILEGE (SALES) AND USE TAX RETURN

License No.

Report Period:

19

City of Chandler

License No.

1

DUE DATE:

The due date for the city privilege tax is the 20th of the month following the reporting period. A return is considered timely if received by

Mail Stop 701

100002000

the last business day of the month. A business day is any day except Saturday, Sunday or a legal City holiday.

PO Box 15001

Period Covered

POSTMARKS ARE NOT EVIDENCE OF TIMELY FILING.

From

To

Chandler, AZ 85244-5001

PENALTIES: 1. Failure to File - A penalty of 5% of the tax due will be assessed for each month, or fraction elapsing between the delinquency

01/01/2001

01/31/2001

date of the return and the date on which it is filed.

Delinquent If Not Received By

2. Failure to Pay - A penalty of 10% of the unpaid tax will be assessed if the tax is not paid timely.

02/28/2001

3. Total Penalty - Total penalties assessed will not exceed 25%.

Taxpayer Business Name

Received

Taxpayer Attention Line

INTEREST: Taxes received after the delinquency date will be assessed interest at a rate of 1% per month until paid.

Taxpayer Address

The interest MAY NOT be abated by the Tax Collector.

2

Taxpayer City/State/ZIP Code

Check here if mailing address has changed.

ALLOWABLE DEDUCTIONS BY BUSINESS ACTIVITY

Please make corrections to the preprinted address.

Bus. Class Code

Activity

Bus. Class Code

Activity

Activity

Bus. Class Code

Activity

Allowed Ded.

Allowed Ded.

Location Address: "Chandler City Location Prints Here"

1

Transportation

52, 64, 81

12

Amusement

52, 64, 81

16

Manufactured Housing

52, 64, 75, 81

52-59, 63-65, 73, 74,

SPECIAL NOTICE

4

Utilities

52, 54, 64, 65, 81

13

Rental of Real Property

52, 54, 64, 75, 81

17

Retail Sales

75, 79, 81, 82, 83

14

Rental Personal Property 52-55, 58, 63-65 , 73,

5

Telecomm.

52, 54, 64, 66, 81

74, 75, 81

9

Publishing

18

Advertising

52, 64, 69, 81

52, 54, 55, 64, 65, 69, 81

52, 62, 64, 70, 71, 75,

10

Printing

52, 54, 55, 64, 65, 74, 81

15

Contracting

25/26

Hotel/Motels

52, 64, 75, 81

81

11

Restaurant /Bar

49/99

Jet Fuel/Use Tax

None

52, 54, 64, 65, 74, 75, 81

General tax rate is 1.5% except Business Class Code 11 = 1.8%, Code 25 = 4.4%, & Codes 4 & 5 = 2.75%

3

Just place a check here and sign at the

T H IS R E T U R N IS D U E O N

bottom if you have no activity to file

T H E 2 0 T H O F T H E M O N T H

SCHEDULE A - DETAILS OF DEDUCTIONS: Enter below the deductions and exclusions you used in computing your City transaction privilege or use

10

9

tax. You must keep a detailed record of all deductions and exclusions. Failure to maintain proper documentation and records required by City

5

6

8

4

7

Column 1

Column 2

Column 3

Column 4

Column 5

Ordinance may result in their disallowance. A separate detail of city records and documentation must be maintained only when the income, deductions,

Business

x Tax Rate

Business Description

Line

Class Code

Gross

= Net Taxable

= Tax Amount

or exemptions are different from state requirements. Please note: Not all deductions are available to all business classifications.

Allowable Sch A pg 2

17

25,000 30

15,725 19

9,275 11

1.50%

139 13

Retail

NOTE: The line numbers at the top of each column below correspond with the line numbers of the business descriptions listed on the front page.

1

Real Prop Rental

13

5,500 65

573 89

4,926 76

1.50%

73 90

2

20

15

15,000 00

8,790 60

6,209 40

1.50%

93 14

Contracting

3

Business Class Code

Business Class Code

Business Class Code

Business Class Code

Business Class Code

Business Class Code

21

11

10,000 00

697 67

9,302 33

1.80%

167 44

Restaurant

4

17

13

15

11

99

Ded.

99

10,000 00

0 00

10,000 00

1.50%

150 00

Use Taxable

5

LINE 1

LINE 2

LINE 3

LINE 4

LINE 5

LINE 6

Deduction Description

Code

52

500.00

6

Discounts and Refunds

10

TOTAL FROM ADDITIONAL PAGES

54

7

Sales for Resale

8

Out-of-State Sales

55

9

Prescriptions/Prosthetics

58

22

10

Gasoline & Use Fuel

59

4,987.81

11

Retail Labor

63

22

680.00

73.89

447.08

697.67

12

Tax Collected or Factored

64

SUBTOTAL

(Add Col. 5 Lines 1 Through 7)

623 61

Qualifying Healthcare Sales

57.38

8

65

11

2 54

9

ENTER EXCESS CITY TAX COLLECTED

Interstate Telecommunications

66

Plus

(+)

GRAND TOTAL

626 15

10

(Add lines 8 plus 9)

National Advertising

69

Equals (=)

12

PENALTY & INTEREST

11

(see instructions on reverse)

13

Exempt Capital Equipment

73

10,000.00

Plus

(+)

22

ENTER TOTAL LIABILITY

626 15

12

(Add Lines 11 plus 12)

Freight-Out/Delivery

74

Equals (=)

14

ENTER CREDIT BALANCE TO BE APPLIED

(Please attach A/R Statement)

15

13

Minus (-)

Food Stamps/WIC

79

ENTER NET AMOUNT DUE

626 15

14

Equals (=)

Bad debts on which tax was paid

81

16

626 15

15

ENTER TOTAL AMOUNT PAID (Make check payable to City of Chandler)

82

Trade-In Allowances

17

17

Mining Supplies

83

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the

Other (explain) _______________

75

best of my knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based upon all

information of which preparer has any knowledge.

Other (explain) _______________

75

75

Other (explain) _______________

18

SALES TO U.S. GOVERNMENT

Ta xpa yer's Sig nature

D ate

P aid Prepa rer's Signa tu re

56

By retailer (50% deductible)

By manufacturer and repairer

(100% deductible)

57

P rint N am e

P hone #

P rint P aid P rep are r's N am e

CONSTRUCTION CONTRACTING

22

A SIGNATURE IS REQUIRED TO MAKE THIS RETURN VALID

70

3,343.52

35% reduction of gross receipts

Return original with remittance in envelope provided.

71

5,000.00

Exempt sub-contracting income

Please make check payable to: CITY OF CHANDLER and list your License number on your check.

Out-of-City Contracting

62

23

Total Deductions

(copy totals to front)

$15,725.19

$573.89

$8,790.60

$697.67

$0.00

$0.00

Speculative Builder Credit (for taxes paid

)

B

S A M P L E R E T U R N - P L E A S E R E T A I N F O R Y O U R R E C O R D S

CHECK YOUR RETURN: Check the amounts recorded by type of income for each line item as follows.

*

Itemized deductions equal the total deductions recorded.

S E E R E V E R S E S I D E F O R S T E P - B Y - S T E P I N S T R U C T I O N S

*

Taxable income equals gross income less total deductions.

*

Tax due is equal to the amount obtained by applying the preprinted tax rate to the taxable income amount.

*

Total tax due equals tax due plus any excess tax collected.

FOR ASSISTANCE, CALL: City of Chandler (480) 782-2280 Fax:(480) 782-2295

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4