Statement Of Financial Condition For Individuals Form 2005 Page 3

ADVERTISEMENT

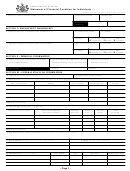

SECTION V – INCOME AND EXPENSE ANALYSIS

(a) Income

(b) Necessary Living Expenses

47. Rent/House payment

$

Source

Gross

Net

48. Groceries

$

49. Allowable installment

(Taxpayer)

39. Wage/Salary

$

$

$

Payments

(Spouse)

40. Wages/Salary

50. Utilities

$

41. Interest - Dividends

51. Transportation

$

42. Net Business Income

52. Insurance

$

(from Form REV-484 or REV-488)

43. Rental Income

53. Medical

$

(Taxpayer)

44. Pension

54. Estimated tax payments

$

(federal-state)

Source:

(Spouse)

45. Pension

(specify)

55. Other expenses

$

Source:

46. TOTAL

$

$

56. TOTAL

$

(income less

Item 40 should be completed if you are married even if your spouse is not liable for

57. Net difference

$

necessary living expenses)

the tax. This information is necessary in order for the Department of Revenue to

calculate household income and expenses.

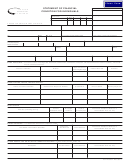

CERTIFICATION – Under penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets, liabilities and other infor-

mation is true, correct and complete.

58. Your Signature

59. Spouse, Attorney or Accountant Signature (POA Attached)

60. Date

– Page 3 –

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3