Form Inh-4 - Application For Determination Of Estate Tax

ADVERTISEMENT

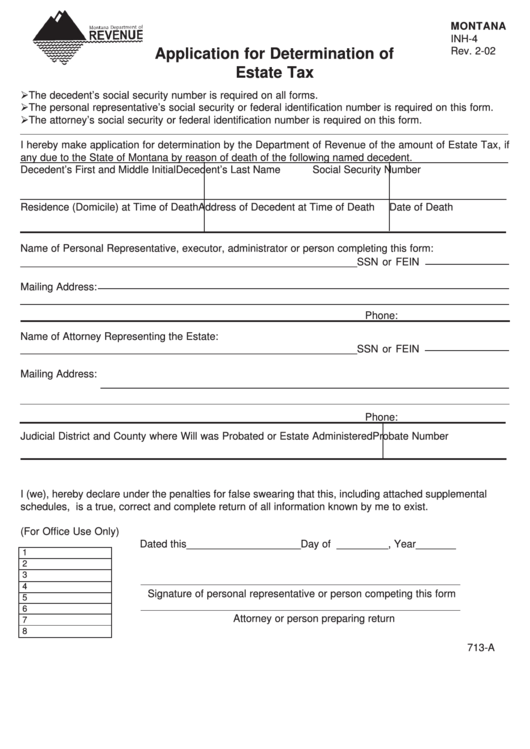

MONTANA

INH-4

Rev. 2-02

Application for Determination of

Estate Tax

The decedent’s social security number is required on all forms.

The personal representative’s social security or federal identification number is required on this form.

The attorney’s social security or federal identification number is required on this form.

I hereby make application for determination by the Department of Revenue of the amount of Estate Tax, if

any due to the State of Montana by reason of death of the following named decedent.

Decedent’s First and Middle Initial

Decedent’s Last Name

Social Security Number

Residence (Domicile) at Time of Death Address of Decedent at Time of Death

Date of Death

Name of Personal Representative, executor, administrator or person completing this form:

___________________________________________________________SSN or FEIN

Mailing Address:

Phone:

Name of Attorney Representing the Estate:

___________________________________________________________SSN or FEIN

Mailing Address:

Phone:

Judicial District and County where Will was Probated or Estate Administered

Probate Number

I (we), hereby declare under the penalties for false swearing that this, including attached supplemental

schedules, is a true, correct and complete return of all information known by me to exist.

(For Office Use Only)

Dated this____________________Day of _________, Year_______

1

2

3

4

Signature of personal representative or person competing this form

5

6

Attorney or person preparing return

7

8

713-A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2