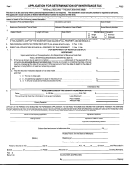

Form Inh-4 - Application For Determination Of Estate Tax Page 2

ADVERTISEMENT

INH-4 Page 2

Computation of Montana Estate Tax

A full copy of the Federal Estate Tax Return, Form 706, must be filed with this return. This form is

to be used for both probate and non-probate estates.

Total State Death Tax Credit allowed (Federal Form 706)

1.

1.

Value of property located outside Montana

2.

2.

Value of Montana property

3.

3.

Value of all property (line 2 plus line 3)

4.

4.

Ratio (line 3 divided by line 4)

5.

5.

6.

6.

Montana Estate Tax (line 5 times line 1)

7.

7.

Interest for late payment (see instructions)

8.

8.

Total due (line 6 plus line 7)

9.

9.

Total paid

10.

10.

Balance due or refundable (line 8 minus line 9)

Instructions for Montana Form INH-4

General Information

Montana Form INH-4 must be filed for the estate of every decedent whose date of death is after 12-31-00

and their estate is above the federal filing requirement.

This return must be filed by the personal representative of the estate. “Personal Representative” means

the personal representative of the decedent, or if there is no personal representative appointed, any

person who is in actual or constructive possession of any property included in the gross estate of the

decedent.

This return is due and any tax liability is payable within 18 months from the date of death.

Specific Instructions

Line 3. Property located in Montana includes all real and tangible property in which the decedent had an

interest.

Line 7. Interest is computed from the date of death, at the rate specified per MCA 72-16-909.

All payments are applied to any interest due, with the balance applied to the tax due.

Mail this form to:

Montana Department of Revenue

PO Box 5805

Helena, MT 59604

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2