Payee Information Form

Download a blank fillable Payee Information Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Payee Information Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

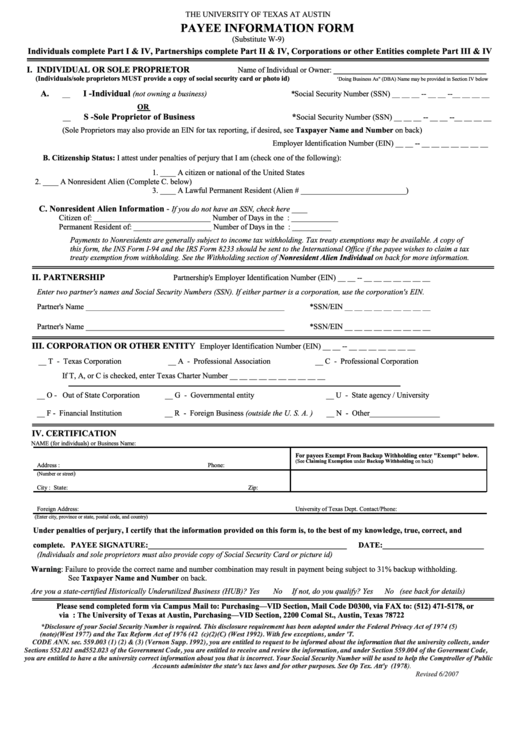

THE UNIVERSITY OF TEXAS AT AUSTIN

PAYEE INFORMATION FORM

(Substitute W-9)

Individuals complete Part I & IV, Partnerships complete Part II & IV, Corporations or other Entities complete Part III & IV

I. INDIVIDUAL OR SOLE PROPRIETOR

___________________________________

Name of Individual or Owner:

(Individuals/sole proprietors MUST provide a copy of social security card or photo id)

‘Doing Business As" (DBA) Name may be provided in Section IV below

A.

I -Individual

__

(not owning a business)

*Social Security Number (SSN) __ __ __ -- __ __ --__ __ __ __

OR

S -Sole Proprietor of Business

*

__

Social Security Number (SSN) __ __ __ -- __ __ --__ __ __ __

(Sole Proprietors may also provide an EIN for tax reporting, if desired, see Taxpayer Name and Number on back)

Employer Identification Number (EIN) __ __ -- __ __ __ __ __ __ __

B. Citizenship Status: I attest under penalties of perjury that I am (check one of the following):

1. ____ A citizen or national of the United States

2. ____ A Nonresident Alien (Complete C. below)

3. ____ A Lawful Permanent Resident (Alien # ___________________________)

C.

Nonresident Alien Information -

If you do not have an SSN, check here ____

Citizen of: ______________________________ Number of Days in the U.S.A. this calendar year: ____________

Permanent Resident of: ____________________ Number of Days in the U.S.A. in the past 12 months: __________

Payments to Nonresidents are generally subject to income tax withholding. Tax treaty exemptions may be available. A copy of

this form, the INS Form I-94 and the IRS Form 8233 should be sent to the International Office if the payee wishes to claim a tax

treaty exemption from withholding. See the Withholding section of Nonresident Alien Individual on back for more information.

II. PARTNERSHIP

Partnership's Employer Identification Number (EIN) __ __ -- __ __ __ __ __ __ __

Enter two partner's names and Social Security Numbers (SSN). If either partner is a corporation, use the corporation's EIN.

Partner's Name ___________________________________________________

*SSN/EIN __ __ __ __ __ __ __ __ __

Partner's Name ___________________________________________________

*SSN/EIN __ __ __ __ __ __ __ __ __

III. CORPORATION OR OTHER ENTITY

Employer Identification Number (EIN) __ __ -- __ __ __ __ __ __ __

__ T - Texas Corporation

__ A - Professional Association

__ C - Professional Corporation

If T, A, or C is checked, enter Texas Charter Number __ __ __ __ __ __ __ __ __ __

__ O - Out of State Corporation

__ G - Governmental entity

__ U - State agency / University

__ F - Financial Institution

__ R - Foreign Business (outside the U. S. A. )

__ N - Other__________________

IV. CERTIFICATION

NAME (for individuals) or Business Name:

For payees Exempt From Backup Withholding enter "Exempt" below.

(See Claiming Exemption under Backup Withholding on back)

Address :

Phone:

)

(Number or street

City :

State:

Zip:

Foreign Address:

University of Texas Dept. Contact/Phone:

(Enter city, province or state, postal code, and country)

Under penalties of perjury, I certify that the information provided on this form is, to the best of my knowledge, true, correct, and

complete. PAYEE SIGNATURE:___________________________________________________

DATE:__________________________

(Individuals and sole proprietors must also provide copy of Social Security Card or picture id)

Warning: Failure to provide the correct name and number combination may result in payment being subject to 31% backup withholding.

See Taxpayer Name and Number on back.

Are you a state-certified Historically Underutilized Business (HUB)? Yes

No

If not, do you qualify? Yes

No

(see back for details)

Please send completed form via Campus Mail to: Purchasing—VID Section, Mail Code D0300, via FAX to: (512) 471-5178, or

via U.S. Mail to: The University of Texas at Austin, Purchasing—VID Section, 2200 Comal St., Austin, Texas 78722

*Disclosure of your Social Security Number is required. This disclosure requirement has been adopted under the Federal Privacy Act of 1974 (5)

U.S.C.A. sec. 552a(note)(West 1977) and the Tax Reform Act of 1976 (42 U.S.C.A. sec. 405(c)(2)(C) (West 1992). With few exceptions, under TEX.GOV'T.

CODE ANN. sec. 559.003 (1) (2) & (3) (Vernon Supp. 1992), you are entitled to request to be informed about the information that the university collects, under

Sections 552.021 and552.023 of the Government Code, you are entitled to receive and review the information, and under Section 559.004 of the Goverment Code,

you are entitled to have a the university correct information about you that is incorrect. Your Social Security Number will be used to help the Comptroller of Public

Accounts administer the state's tax laws and for other purposes. See Op Tex. Att'y Gen.No. H-1255(1978).

Revised 6/2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2