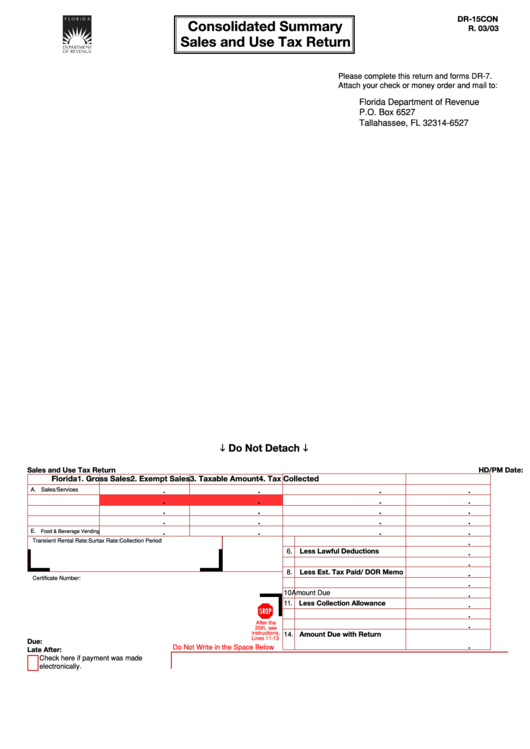

Form Dr-15con - Consolidated Summary Sales And Use Tax Return - 2003

ADVERTISEMENT

DR-15CON

Consolidated Summary

R. 03/03

Sales and Use Tax Return

Please complete this return and forms DR-7.

Attach your check or money order and mail to:

Florida Department of Revenue

P.O. Box 6527

Tallahassee, FL 32314-6527

Do Not Detach

Sales and Use Tax Return

HD/PM Date:

/

/

DR-15CON R. 03/03

Florida

1. Gross Sales

2. Exempt Sales

3. Taxable Amount

4. Tax Collected

A. Sales/Services

.

.

.

.

B. Taxable Purchases

.

.

.

.

C. Commercial Rentals

.

.

.

.

D. Transient Rentals

.

.

.

.

E.

.

.

.

.

Food & Beverage Vending

Transient Rental Rate:

Surtax Rate:

Collection Period

5. Total Amount of Tax Collected

.

6. Less Lawful Deductions

.

7. Total Tax Due

.

8. Less Est. Tax Paid/ DOR Memo

.

Certificate Number:

9. Plus Est. Tax Due Current Month

.

10

Amount Due

.

11. Less Collection Allowance

.

12. Plus Penalty

.

After the

13. Plus Interest

.

20th, see

instructions,

14. Amount Due with Return

Lines 11-13

Due:

.

Do Not Write in the Space Below

Late After:

9000 002003999900001000999 0 7999999999 0000 4

Check here if payment was made

electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2