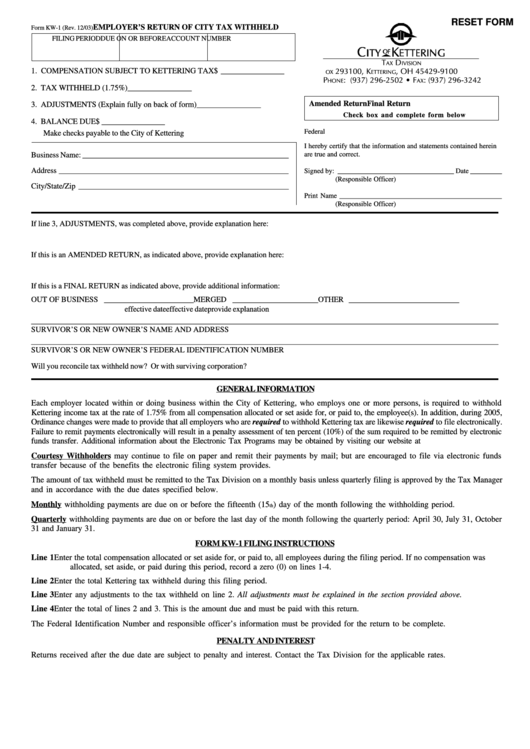

RESET FORM

EMPLOYER’S RETURN OF CITY TAX WITHHELD

Form KW-1 (Rev. 12/03)

FILING PERIOD

DUE ON OR BEFORE

ACCOUNT NUMBER

T

D

AX

IVISION

1. COMPENSATION SUBJECT TO KETTERING TAX $ ________________

P.O. B

293100, K

, OH 45429-9100

OX

ETTERING

P

: (937) 296-2502 • F

: (937) 296-3242

HONE

AX

2. TAX WITHHELD (1.75%)

________________

Amended Return

Final Return

3. ADJUSTMENTS (Explain fully on back of form)

________________

Check box and complete form below

4. BALANCE DUE

$ ________________

Federal I.D. Number _______________________________________

Make checks payable to the City of Kettering

I hereby certify that the information and statements contained herein

Business Name: _____________________________________________________

are true and correct.

Address ___________________________________________________________

Signed by: _________________________________ Date _________

(Responsible Officer)

City/State/Zip ______________________________________________________

Print Name ______________________________________________

(Responsible Officer)

If line 3, ADJUSTMENTS, was completed above, provide explanation here:

If this is an AMENDED RETURN, as indicated above, provide explanation here:

If this is a FINAL RETURN as indicated above, provide additional information:

OUT OF BUSINESS

_______________________ MERGED

______________________

OTHER

_____________________________

effective date

effective date

provide explanation

_________________________________________________________________________________________________________________________

SURVIVOR’S OR NEW OWNER’S NAME AND ADDRESS

_________________________________________________________________________________________________________________________

SURVIVOR’S OR NEW OWNER’S FEDERAL IDENTIFICATION NUMBER

Will you reconcile tax withheld now?

Or with surviving corporation?

GENERAL INFORMATION

Each employer located within or doing business within the City of Kettering, who employs one or more persons, is required to withhold

Kettering income tax at the rate of 1.75% from all compensation allocated or set aside for, or paid to, the employee(s). In addition, during 2005,

Ordinance changes were made to provide that all employers who are required to withhold Kettering tax are likewise required to file electronically.

Failure to remit payments electronically will result in a penalty assessment of ten percent (10%) of the sum required to be remitted by electronic

funds transfer. Additional information about the Electronic Tax Programs may be obtained by visiting our website at .

Courtesy Withholders may continue to file on paper and remit their payments by mail; but are encouraged to file via electronic funds

transfer because of the benefits the electronic filing system provides.

The amount of tax withheld must be remitted to the Tax Division on a monthly basis unless quarterly filing is approved by the Tax Manager

and in accordance with the due dates specified below.

Monthly withholding payments are due on or before the fifteenth (15

) day of the month following the withholding period.

th

Quarterly withholding payments are due on or before the last day of the month following the quarterly period: April 30, July 31, October

31 and January 31.

FORM KW-1 FILING INSTRUCTIONS

Line 1

Enter the total compensation allocated or set aside for, or paid to, all employees during the filing period. If no compensation was

allocated, set aside, or paid during this period, record a zero (0) on lines 1-4.

Line 2

Enter the total Kettering tax withheld during this filing period.

Line 3

Enter any adjustments to the tax withheld on line 2. All adjustments must be explained in the section provided above.

Line 4

Enter the total of lines 2 and 3. This is the amount due and must be paid with this return.

The Federal Identification Number and responsible officer’s information must be provided for the return to be complete.

PENALTY AND INTEREST

Returns received after the due date are subject to penalty and interest. Contact the Tax Division for the applicable rates.

1

1