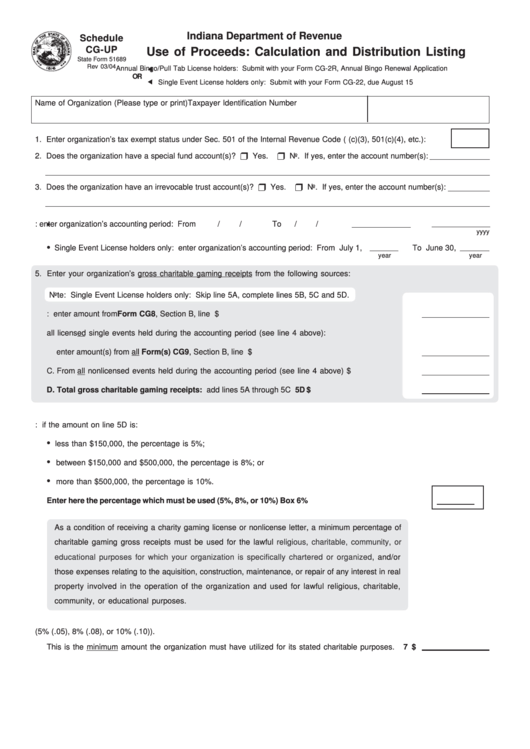

Form 51689 - Use Of Proceeds: Calculation And Distribution Listing

ADVERTISEMENT

Indiana Department of Revenue

Schedule

CG-UP

Use of Proceeds: Calculation and Distribution Listing

State Form 51689

Rev 03/04

Annual Bingo/Pull Tab License holders: Submit with your Form CG-2R, Annual Bingo Renewal Application

OR

Single Event License holders only: Submit with your Form CG-22, due August 15

Name of Organization (Please type or print)

Taxpayer Identification Number

1. Enter organization’s tax exempt status under Sec. 501 of the Internal Revenue Code (e.g. 501(c)(3), 501(c)(4), etc.):

2. Does the organization have a special fund account(s)?

Yes.

No. If yes, enter the account number(s):

3. Does the organization have an irrevocable trust account(s)?

Yes.

No. If yes, enter the account number(s):

•

4.

Annual Bingo/Pull Tab License holders: enter organization’s accounting period: From

/

/

To

/

/

m m

dd

yy

m m

dd

yy

•

Single Event License holders only: enter organization’s accounting period: From July 1,

To June 30,

year

year

5. Enter your organization’s gross charitable gaming receipts from the following sources:

Note: Single Event License holders only: Skip line 5A, complete lines 5B, 5C and 5D.

A. From Annual Bingo and/or Pull Tab License: enter amount from Form CG8, Section B, line A .......

5A $

B. From all licensed single events held during the accounting period (see line 4 above):

enter amount(s) from all Form(s) CG9, Section B, line A ...................................................................

5B $

C. From all nonlicensed events held during the accounting period (see line 4 above) ........................

5C$

D. Total gross charitable gaming receipts: add lines 5A through 5C .................................................

5D $

6. Minimum percentage for charitable use: if the amount on line 5D is:

•

less than $150,000, the percentage is 5%;

•

between $150,000 and $500,000, the percentage is 8%; or

•

more than $500,000, the percentage is 10%.

Enter here the percentage which must be used (5%, 8%, or 10%) .....................................................

Box 6

%

As a condition of receiving a charity gaming license or nonlicense letter, a minimum percentage of

charitable gaming gross receipts must be used for the lawful

religious, charitable, community, or

educational purposes for which your organization is specifically chartered or

organized, and/or

those expenses relating to the aquisition, construction, maintenance, or repair of any interest in real

property involved in the operation of the organization and used for lawful religious, charitable,

community, or educational purposes.

7. Multiply the entry on line 5D by the applicable percentage in Box 6 (5% (.05), 8% (.08), or 10% (.10)).

This is the minimum amount the organization must have utilized for its stated charitable purposes.

7 $

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2