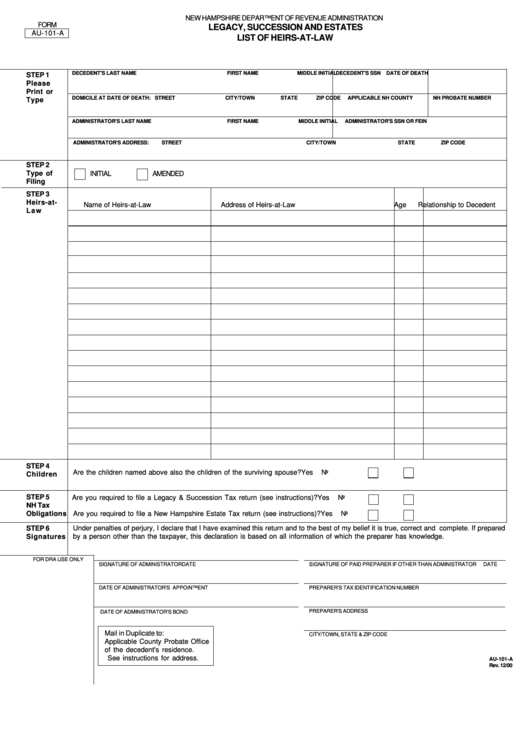

Form Au-101-A - Legacy, Succession And Estates List Of Heirs-At-Law

ADVERTISEMENT

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

LEGACY, SUCCESSION AND ESTATES

AU-101-A

LIST OF HEIRS-AT-LAW

DECEDENT'S LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEDENT'S SSN

DATE OF DEATH

STEP 1

Please

Print or

DOMICILE AT DATE OF DEATH: STREET

CITY/TOWN

STATE

ZIP CODE

APPLICABLE NH COUNTY

NH PROBATE NUMBER

Type

ADMINISTRATOR'S LAST NAME

FIRST NAME

MIDDLE INITIAL

ADMINISTRATOR'S SSN OR FEIN

ADMINISTRATOR'S ADDRESS:

STREET

CITY/TOWN

STATE

ZIP CODE

STEP 2

Type of

INITIAL

AMENDED

Filing

STEP 3

Heirs-at-

Name of Heirs-at-Law

Address of Heirs-at-Law

Age

Relationship to Decedent

L a w

STEP 4

Are the children named above also the children of the surviving spouse?

Yes

No

Children

STEP 5

Are you required to file a Legacy & Succession Tax return (see instructions)?

Yes

No

NH Tax

Obligations Are you required to file a New Hampshire Estate Tax return (see instructions)?

Yes

No

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete. If prepared

STEP 6

Signatures

by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

FOR DRA USE ONLY

SIGNATURE OF ADMINISTRATOR

DATE

SIGNATURE OF PAID PREPARER IF OTHER THAN ADMINISTRATOR DATE

DATE OF ADMINISTRATOR'S APPOINTMENT

PREPARER'S TAX IDENTIFICATION NUMBER

PREPARER'S ADDRESS

DATE OF ADMINISTRATOR'S BOND

Mail in Duplicate to:

CITY/TOWN, STATE & ZIP CODE

Applicable County Probate Office

of the decedent's residence.

See instructions for address.

AU-101-A

Rev. 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2