Form Hud-40105 - Property Completion Form - U.s. Department Of Housing And Urban Development Page 2

ADVERTISEMENT

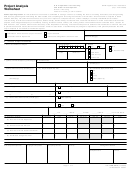

Part D. Homebuyer Financing Information

Complete this part only if the unit was transferred by lease-purchase. Do not complete

for units transferred fee simple that were previously reported on Part D of the Property Transfer form, HUD-40104.

1.

Sale of Property to the Homebuyer

*

(a) Fair Market Value at Sale:

(b) Sales Price:

(c) Closing Costs:

(d) HOPE 3 Promissory Note Amount: (e) Monthly PITI:

$

$

$

$

$

*

Must be not less than 20% and not more than 30% of the

If Fair Market Value at Sale (item 1(a)) is different than

the after-

adjusted income of the family shown in Part C, House-

rehabilitation Fair Market Value, enter after rehabilitation Fair Market Value :

hold Characteristics, item 1a of form HUD-40104.

$

2. Homebuyer Financing of Purchases and Rehabilitation

For properties transferred under lease-purchase:

(1) complete column (a), below.

(2) is the cost of rehabilitation included in the purchase price?

Yes

No

If "No," provide information on rehabilitation financing in column (b), below.

(a)

(b)

Homebuyer's Financing for

Homebuyer's Financing

HOPE 3 Funds

Purchase (including closing costs)

for Rehabilitation

Note: Do not include HOPE 3 Promissory Note amount in this section if the note includes only a discounted purchase price to homebuyer below FMV.

Do include other financial assistance or subsidy to the homebuyer, such as downpayment assistance, rehabilitation financing, or purchase money

mortgages that are not repayable on an amortizing basis, on line 1 or 2 of this section. In such cases, the HOPE 3 Promissory Note amount shown in

item 1(d) above should include the total financial assistance to homebuyer (See Section 572.130(d)).

Grant

1.

Deferred Payment Loan

2.

Direct Loan

3.

Subtotal

4.

Other Public Funds

Grant

1.

Deferred Payment Loan

2.

Direct Loan

3.

Subtotal

4.

Private Funds

Homebuyer Cash

1.

Homebuyer Sweat Equity

2.

Private Grant

3.

Private Loan

4.

Subtotal

5.

Total Financing

(column 3(a) must equal items 1(b) plus 1(c) above)

3. Type of Homebuyer Financing:

(mark all that apply)

Conventional Mortgage

VA Insured Mortgage

State HFA

(a)

(e)

(i)

FHA 203(b) Mortgage

FmHA

Other

(b)

(f)

(z)

(specify):

FHA 203(k) Mortgage

Grantee

(c)

(g)

FHA Other

RTC

(d)

(h)

Warning: HUD will prosecute false claims and statements. Conviction may result in criminal and/or civil penalties. (18 U.S.C. 1001, 1010, 1012; 31 U.S.C.

3729, 3802)

4. Name & Phone Number (including area code) of the Person who Completed this Form:

6. Date

Privacy Statement: Public Law 97-255, Financial Integrity Act, 31 U.S.C. 3512, authorizes the Department of Housing and Urban Development (HUD) to collect all the information

(except the Social Security Number (SSN)) which will be used by HUD to protect disbursement data from fraudulent actions. The Housing and Community Development Act of 1987,

42 U.S.C. 3543, authorizes HUD to collect the SSN. The data are used to ensure that individuals who no longer require access to Line of Credit Control System (LOCCS) have

their access capability promptly deleted. Provision of the SSN is mandatory. HUD uses it as a unique identifier for safeguarding LOCCS from unauthorized access. Failure to provide

the information requested may delay the processing of your approval for access to LOCCS. This information will not be otherwise disclosed or released outside of HUD, except

as permitted or required by law.

page 2 of 3

form HUD-40105 (7/94)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2