Form Wv/mitc-1 - Schedule Mitc-1 (For Periods Prior To January 1, 2015) - Credit For Manufacturing Investment - Wv State Tax Department Page 2

ADVERTISEMENT

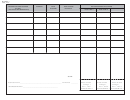

11. Available Annual Manufacturing Investment Tax Credit Adjusted for Severance Tax Claim

(Subtract the amount on line10g from the amount on line 8) ...................................................................

$

$

12. a) Total Business Franchise Tax........................................................................................................................

$

b) Amount of Other Credits Used to Offset Business Franchise Tax...........................................................

c) Adjusted Business Franchise Tax (Subtract the amount on line 12b from the amount on

$

line 12a and enter here)..................................................................................................................................

d) Business Franchise Tax Manufacturing Investment Tax Credit Offset Limit (Multiply the

$

amount on line12a by the value on line 9)....................................................................................................

$

e) Amount of W. VA. Code §11-13D Credits Used to Offset Business Franchise Tax...............................

f) Business Franchise Tax Limit of Manufacturing Investment Tax Credit (Subtract the

amount on line 12e from the amount on line 12d. Enter zero, if the amount on

$

line 12e is greater than the amount on line 12d )........................................................................................

g) Business Franchise Tax Manufacturing Investment Tax Credit (Enter the lesser of

$

the values on lines 11, 12c and line 12f here and on the tax return)........................................................

13. Available Annual Manufacturing Investment Tax Credit Adjusted for Business Franchise Tax Claim

$

(Subtract the amount on line12g from the amount on line 11)........................................................................

$

14. a) Total Corporation Net Income Tax.................................................................................................................

$

b) Amount of Other Credits Used to Offset Corporation Net Income Tax....................................................

c) Adjusted Corporation Net Income Tax (Subtract the amount on line 14b from the amount on

$

line 14a and enter here)...................................................................................................................................

d) Corporation Net Income Tax Manufacturing Investment Tax Credit Offset Limit (Multiply the

$

amount on line14a by the value on line 9)....................................................................................................

$

e) Amount of W. VA. Code §11-13D Credits Used to Offset Corporation Net Income Tax........................

f) Corporation Net Income Tax Limit of Manufacturing Investment Tax Credit (Subtract the

amount on line 14e from the amount on line 14d. Enter zero, if the amount on

$

line 14e is greater than the amount on line 14d )........................................................................................

g) Corporation Net Income Tax Manufacturing Investment Tax Credit (Enter the lesser of

$

the values on lines 13, 14c and line 14f here and on the tax return)........................................................

Note that the sum of credit claimed on Lines 10g, 12g, and 14g may not exceed the amount on line 8. the total annual credit available.

The W. Va. Code §11-13D credits amounts to be entered on Lines 10e, 12e, and 14e include the Industrial Expansion and revitalization

credit, Research and Development Credit, Residential Housing Development Credit, Aerospace Industrial Facility Credit). Unused

annual credit forfeited.

Under penalties of perjury, I declare that I have examined this credit claim form (including accompanying schedules and statements) and to the best of

my knowledge it is true, and complete.

Signature of Taxpayer

Name of Taxpayer: Type or Print

Title

Date

Person to Contact Concerning this Return

Telephone Number

Signature of Preparer other than Taxpayer

Address

Title

Date

ADVERTISEMENT

0 votes

1

1 2

2 3

3

![Form Rp-485-k [utica Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts Form Rp-485-k [utica Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts](https://data.formsbank.com/pdf_docs_html/320/3209/320955/page_1_thumb.png)

![Form Rp-485-l [amsterdam Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts Form Rp-485-l [amsterdam Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts](https://data.formsbank.com/pdf_docs_html/320/3209/320964/page_1_thumb.png)

![Form Rp-485-m [rome Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts Form Rp-485-m [rome Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts](https://data.formsbank.com/pdf_docs_html/320/3209/320966/page_1_thumb.png)

![Form Rp-485-k [utica Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts Form Rp-485-k [utica Sd] - Application For Residential Investment Real Property Tax Exemption; Certain School Districts](https://data.formsbank.com/pdf_docs_html/362/3621/362133/page_1_thumb.png)