Form W1 - Employer'S Return Of Tax Withheld - City Of North Ridgeville

ADVERTISEMENT

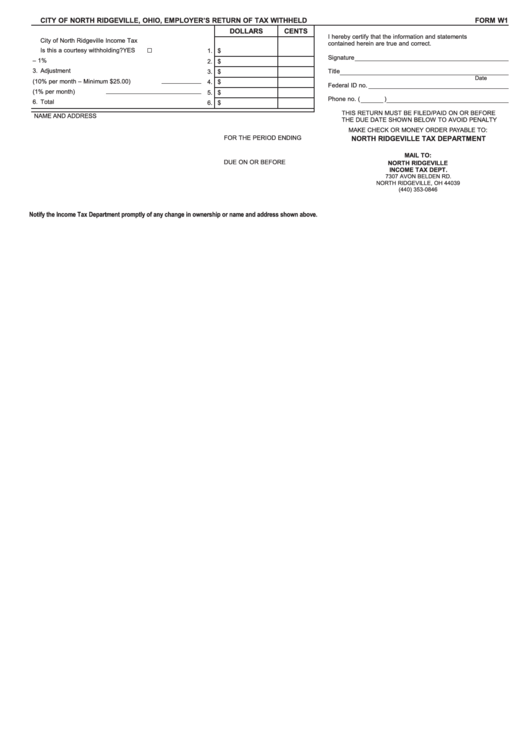

CITY OF NORTH RIDGEVILLE, OHIO, EMPLOYER’S RETURN OF TAX WITHHELD

FORM W1

DOLLARS

CENTS

1. Taxable Earnings paid all Employees subject to

I hereby certify that the information and statements

City of North Ridgeville Income Tax

contained herein are true and correct.

Is this a courtesy withholding?

YES

1.

$

Signature

2. Tax Withheld in month/quarter – 1%

2.

$

3. Adjustment

Title

3.

$

Date

4. Penalty (10% per month – Minimum $25.00)

4.

$

Federal ID no.

5. Interest (1% per month)

5.

$

Phone no. (

)

6. Total

6.

$

THIS RETURN MUST BE FILED/PAID ON OR BEFORE

NAME AND ADDRESS

THE DUE DATE SHOWN BELOW TO AVOID PENALTY

MAKE CHECK OR MONEY ORDER PAYABLE TO:

FOR THE PERIOD ENDING

NORTH RIDGEVILLE TAX DEPARTMENT

MAIL TO:

DUE ON OR BEFORE

NORTH RIDGEVILLE

INCOME TAX DEPT.

7307 AVON BELDEN RD.

NORTH RIDGEVILLE, OH 44039

(440) 353-0846

Notify the Income Tax Department promptly of any change in ownership or name and address shown above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1