Form W1 - Employer'S Return Of Tax Withheld - 2009

ADVERTISEMENT

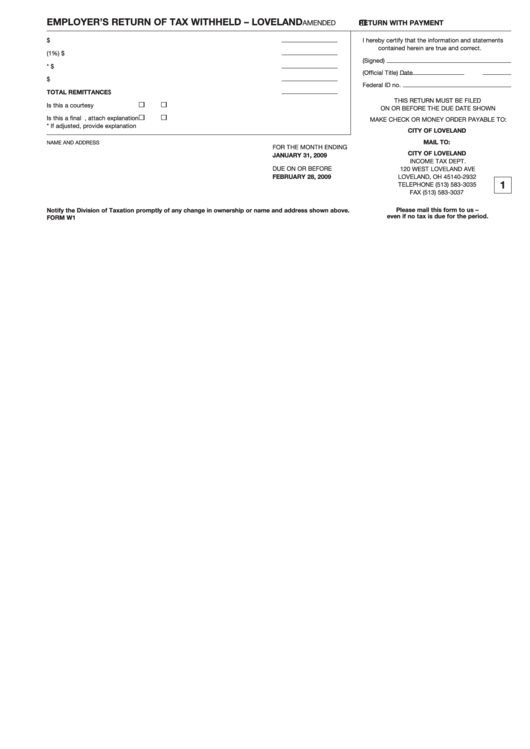

EMPLOYER’S RETURN OF TAX WITHHELD – LOVELAND

AMENDED

RETURN WITH PAYMENT

1. PAYROLL THIS PERIOD.......................................................................................... $

I hereby certify that the information and statements

contained herein are true and correct.

2. TAX (1%) .................................................................................................................. $

(Signed)

3. ADJUSTMENT* ........................................................................................................ $

(Official Title)

Date

4. AMOUNT REMITTED............................................................................................... $

Federal ID no.

TOTAL REMITTANCE .................................................................................................. $

THIS RETURN MUST BE FILED

Is this a courtesy withholding ......

Yes

No

ON OR BEFORE THE DUE DATE SHOWN

Is this a final return.......................

Yes

No

If yes, attach explanation

MAKE CHECK OR MONEY ORDER PAYABLE TO:

* If adjusted, provide explanation

CITY OF LOVELAND

MAIL TO:

NAME AND ADDRESS

FOR THE MONTH ENDING

CITY OF LOVELAND

JANUARY 31, 2009

INCOME TAX DEPT.

DUE ON OR BEFORE

120 WEST LOVELAND AVE

FEBRUARY 28, 2009

LOVELAND, OH 45140-2932

1

TELEPHONE (513) 583-3035

FAX (513) 583-3037

Please mail this form to us –

Notify the Division of Taxation promptly of any change in ownership or name and address shown above.

even if no tax is due for the period.

FORM W1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16