Information On Property Tax Bills Form 2007

ADVERTISEMENT

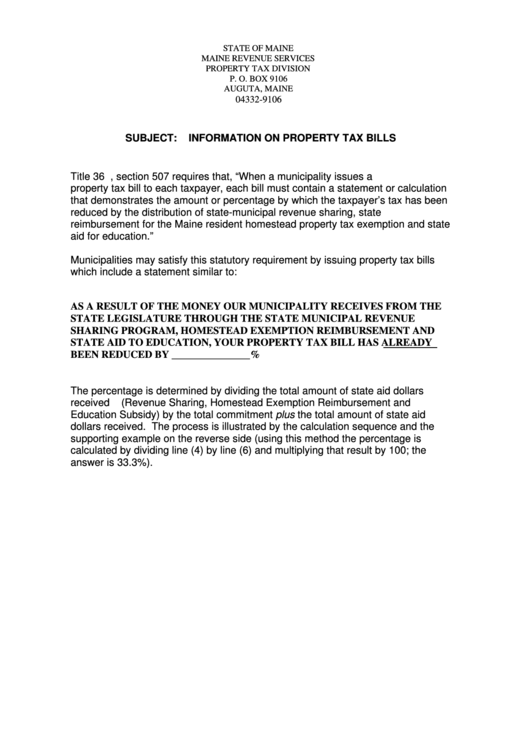

STATE OF MAINE

MAINE REVENUE SERVICES

PROPERTY TAX DIVISION

P. O. BOX 9106

AUGUTA, MAINE

04332-9106

SUBJECT:

INFORMATION ON PROPERTY TAX BILLS

Title 36 M.R.S.A., section 507 requires that, “When a municipality issues a

property tax bill to each taxpayer, each bill must contain a statement or calculation

that demonstrates the amount or percentage by which the taxpayer’s tax has been

reduced by the distribution of state-municipal revenue sharing, state

reimbursement for the Maine resident homestead property tax exemption and state

aid for education.”

Municipalities may satisfy this statutory requirement by issuing property tax bills

which include a statement similar to:

AS A RESULT OF THE MONEY OUR MUNICIPALITY RECEIVES FROM THE

STATE LEGISLATURE THROUGH THE STATE MUNICIPAL REVENUE

SHARING PROGRAM, HOMESTEAD EXEMPTION REIMBURSEMENT AND

STATE AID TO EDUCATION, YOUR PROPERTY TAX BILL HAS ALREADY

BEEN REDUCED BY _______________%

The percentage is determined by dividing the total amount of state aid dollars

received

(Revenue Sharing, Homestead Exemption Reimbursement and

Education Subsidy) by the total commitment plus the total amount of state aid

dollars received. The process is illustrated by the calculation sequence and the

supporting example on the reverse side (using this method the percentage is

calculated by dividing line (4) by line (6) and multiplying that result by 100; the

answer is 33.3%).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2