Form I-018 - Property Tax Bill / Closing Statement And Sale Of Home Information - 2002

ADVERTISEMENT

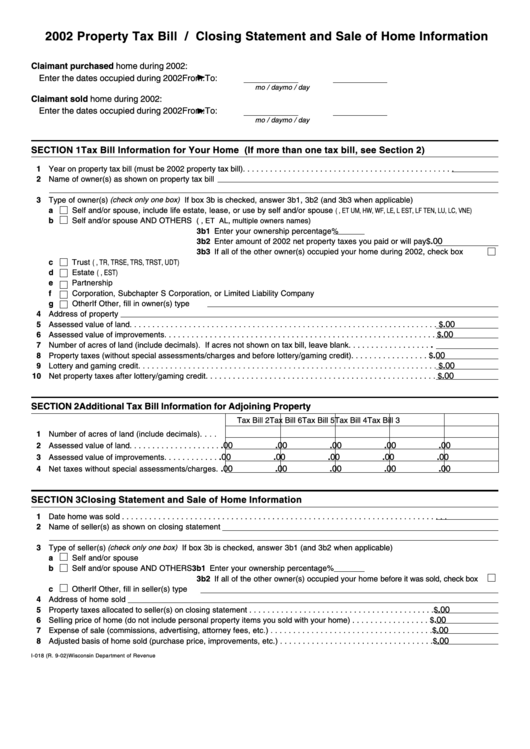

2002 Property Tax Bill / Closing Statement and Sale of Home Information

Claimant purchased home during 2002:

Enter the dates occupied during 2002

From:

To:

mo / day

mo / day

Claimant sold home during 2002:

Enter the dates occupied during 2002

From:

To:

mo / day

mo / day

SECTION 1

Tax Bill Information for Your Home (If more than one tax bill, see Section 2)

1 Year on property tax bill (must be 2002 property tax bill) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Name of owner(s) as shown on property tax bill

3 Type of owner(s) (check only one box) If box 3b is checked, answer 3b1, 3b2 (and 3b3 when applicable)

a

Self and/or spouse, include life estate, lease, or use by self and/or spouse

(e.g. ET UX, ET UM, HW, WF, LE, L EST, LF TEN, LU, LC, VNE)

b

Self and/or spouse AND OTHERS

(e.g., ET AL, multiple owners names)

3b1 Enter your ownership percentage

%

.00

3b2 Enter amount of 2002 net property taxes you paid or will pay $

3b3 If all of the other owner(s) occupied your home during 2002, check box

c

Trust

(e.g., TR, TRSE, TRS, TRST, UDT)

d

Estate

(e.g., EST)

e

Partnership

f

Corporation, Subchapter S Corporation, or Limited Liability Company

g

Other

If Other, fill in owner(s) type

4 Address of property

.00

5 Assessed value of land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.00

6 Assessed value of improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.

7 Number of acres of land (include decimals). If acres not shown on tax bill, leave blank . . . . . . . . . . . . . . . . . .

.00

8 Property taxes (without special assessments/charges and before lottery/gaming credit) . . . . . . . . . . . . . . . . . $

.00

9 Lottery and gaming credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.00

10 Net property taxes after lottery/gaming credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

SECTION 2

Additional Tax Bill Information for Adjoining Property

Tax Bill 2

Tax Bill 3

Tax Bill 4

Tax Bill 5

Tax Bill 6

.

.

.

.

.

1 Number of acres of land (include decimals) . . . .

.00

.00

.00

.00

.00

2 Assessed value of land . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

.00

3 Assessed value of improvements . . . . . . . . . . . .

.00

.00

.00

.00

.00

4 Net taxes without special assessments/charges .

SECTION 3

Closing Statement and Sale of Home Information

1 Date home was sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Name of seller(s) as shown on closing statement

3 Type of seller(s) (check only one box) If box 3b is checked, answer 3b1 (and 3b2 when applicable)

a

Self and/or spouse

b

Self and/or spouse AND OTHERS 3b1 Enter your ownership percentage

%

3b2 If all of the other owner(s) occupied your home before it was sold, check box

c

Other

If Other, fill in seller(s) type

4 Address of home sold

.00

5 Property taxes allocated to seller(s) on closing statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.00

6 Selling price of home (do not include personal property items you sold with your home) . . . . . . . . . . . . . . . . . $

.00

7 Expense of sale (commissions, advertising, attorney fees, etc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

.00

8 Adjusted basis of home sold (purchase price, improvements, etc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

I-018 (R. 9-02)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1