Form Jw-3 - Reconciliation Of Jedd Income Tax Withheld - 2005

ADVERTISEMENT

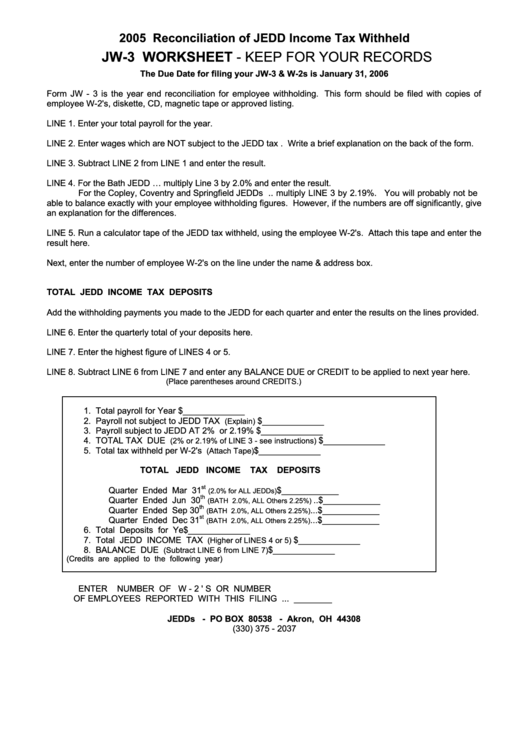

2005 Reconciliation of JEDD Income Tax Withheld

JW-3 WORKSHEET - KEEP FOR YOUR RECORDS

The Due Date for filing your JW-3 & W-2s is January 31, 2006

Form JW - 3 is the year end reconciliation for employee withholding. This form should be filed with copies of

employee W-2's, diskette, CD, magnetic tape or approved listing.

LINE 1. Enter your total payroll for the year.

LINE 2. Enter wages which are NOT subject to the JEDD tax . Write a brief explanation on the back of the form.

LINE 3. Subtract LINE 2 from LINE 1 and enter the result.

LINE 4. For the Bath JEDD … multiply Line 3 by 2.0% and enter the result.

For the Copley, Coventry and Springfield JEDDs .. multiply LINE 3 by 2.19%. You will probably not be

able to balance exactly with your employee withholding figures. However, if the numbers are off significantly, give

an explanation for the differences.

LINE 5. Run a calculator tape of the JEDD tax withheld, using the employee W-2's. Attach this tape and enter the

result here.

Next, enter the number of employee W-2's on the line under the name & address box.

TOTAL JEDD INCOME TAX DEPOSITS

Add the withholding payments you made to the JEDD for each quarter and enter the results on the lines provided.

LINE 6. Enter the quarterly total of your deposits here.

LINE 7. Enter the highest figure of LINES 4 or 5.

LINE 8. Subtract LINE 6 from LINE 7 and enter any BALANCE DUE or CREDIT to be applied to next year here.

(Place parentheses around CREDITS.)

1. Total payroll for Year .................................................................... $_____________

2. Payroll not subject to JEDD TAX

................................... $_____________

(Explain)

3. Payroll subject to JEDD AT 2% or 2.19% ................................... $_____________

4. TOTAL TAX DUE

......... $_____________

(2% or 2.19% of LINE 3 - see instructions)

5. Total tax withheld per W-2's

.................................... $_____________

(Attach Tape)

TOTAL JEDD INCOME

TAX

DEPOSITS

st

Quarter Ended Mar 31

................. $ ____________

(2.0% for ALL JEDDs)

th

Quarter Ended Jun 30

.. $ ____________

(BATH 2.0%, ALL Others 2.25%)

th

Quarter Ended Sep 30

... $ ____________

(BATH 2.0%, ALL Others 2.25%)

st

Quarter Ended Dec 31

... $ ____________

(BATH 2.0%, ALL Others 2.25%)

6. Total Deposits for Year .............................................................. $_____________

7. Total JEDD INCOME TAX

.................... $_____________

(Higher of LINES 4 or 5)

8. BALANCE DUE

............................. $_____________

(Subtract LINE 6 from LINE 7)

(Credits are applied to the following year)

ENTER

NUMBER OF W - 2 ' S OR NUMBER

OF EMPLOYEES REPORTED WITH THIS FILING ....................

________

JEDDs - PO BOX 80538 - Akron, OH 44308

(330) 375 - 2037

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1