Form Br - Akron Income Tax Business Return

ADVERTISEMENT

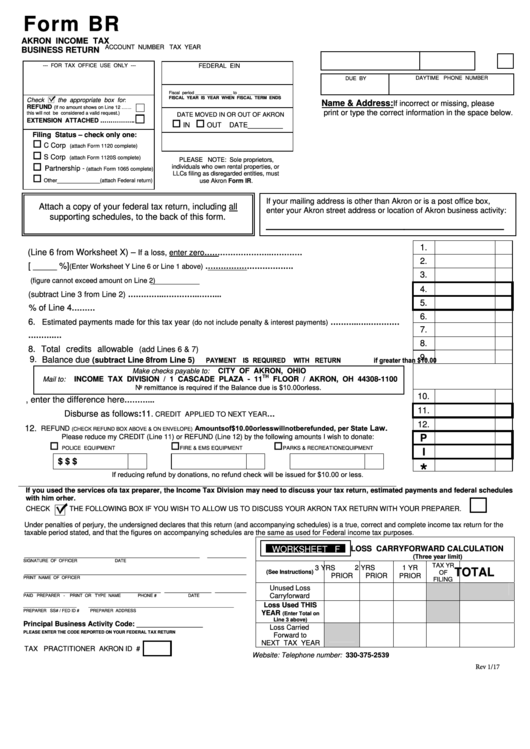

Form BR

AKRON INCOME TAX

ACCOUNT NUMBER

TAX YEAR

BUSINESS RETURN

--- FOR TAX OFFICE USE ONLY ---

FEDERAL EIN

DAYTIME PHONE NUMBER

DUE BY

Fiscal period ________________ to __________________

FISCAL YEAR IS YEAR WHEN FISCAL TERM ENDS

Check

the appropriate box for

:

Name & Address:

If incorrect or missing, please

REFUND

(If no amount shows on Line 12

…….

print or type the correct information in the space below.

this will not be considered a valid request.)

DATE MOVED IN OR OUT OF AKRON

EXTENSION ATTACHED ……………..

IN

OUT

DATE_________

Filing Status – check only one:

C Corp

(attach Form 1120 complete)

S Corp

(attach Form 1120S complete)

PLEASE NOTE: Sole proprietors,

individuals who own rental properties, or

Partnership -

(attach Form 1065 complete)

LLCs filing as disregarded entities, must

___________

use Akron Form IR.

Other

(attach Federal return)

If your mailing address is other than Akron or is a post office box,

Attach a copy of your federal tax return, including all

enter your Akron street address or location of Akron business activity:

supporting schedules, to the back of this form.

_______________________________

1.

1. Enter City Net Profit (Line 6 from Worksheet X) –

If a loss, enter zero……………………..………….......

2.

2. Amount allocable to Akron[ _____ %]

…………………………….

(Enter Worksheet Y Line 6 or Line 1 above)

3.

3. Net Loss Carryforward from Worksheet F

.......................................

(figure cannot exceed amount on Line 2)

4.

4. Adjusted Net Income subject to Akron tax

(subtract Line 3 from Line 2) …………..………......…..……...

5.

5. Akron Income Tax - 2.25% of Line 4

.......................................................................................………....

6.

6.

Estimated payments made for this tax year

………..….………….....

(do not include penalty & interest payments)

7.

7. Amount of prior year credits

......................…….............................................................................….….....

8.

8. Total credits allowable

(add Lines 6 & 7) .....................................................................................................

9.

PAYMENT IS REQUIRED

WITH RETURN if greater than $10.00

9. Balance due

(subtract Line 8 from Line 5)

Make checks payable to:

CITY OF AKRON, OHIO

TH

Mail to:

INCOME TAX DIVISION / 1 CASCADE PLAZA - 11

FLOOR / AKRON, OH 44308-1100

No remittance is required if the Balance due is $10.00 or less.

10.

10. If Line 8 is greater than Line 5, enter the difference here

.........................................................………...

11.

Disburse as follows: 11.

.................…...........................................

CREDIT APPLIED TO NEXT YEAR

12.

Law.

Amounts of $10.00 or less will not be refunded, per State

12.

REFUND

(CHECK REFUND BOX ABOVE & ON ENVELOPE)

Please reduce my CREDIT (Line 11) or REFUND (Line 12) by the following amounts I wish to donate:

P

POLICE EQUIPMENT

FIRE & EMS EQUIPMENT

PARKS & RECREATION EQUIPMENT

I

$

$

$

*

If reducing refund by donations, no refund check will be issued for $10.00 or less.

_________________________________________________________________________________________________

If you used the services of a tax preparer, the Income Tax Division may need to discuss your tax return, estimated payments and federal schedules

with him or her.

CHECK

THE FOLLOWING BOX IF YOU WISH TO ALLOW US TO DISCUSS YOUR AKRON TAX RETURN WITH YOUR PREPARER.

Under penalties of perjury, the undersigned declares that this return (and accompanying schedules) is a true, correct and complete income tax return for the

taxable period stated, and that the figures on accompanying schedules are the same as used for Federal income tax purposes.

LOSS CARRYFORWARD CALCULATION

WORKSHEET F

_____________________________________________

__________

(Three year limit)

SIGNATURE OF OFFICER

DATE

TAX YR

3 YRS

2 YRS

1 YR

TOTAL

_________________________________________________________

(See Instructions)

OF

PRIOR

PRIOR

PRIOR

PRINT NAME OF OFFICER

FILING

Unused Loss

___________________________________ ____________ ________

Carryforward

PAID PREPARER -

PRINT OR TYPE NAME

PHONE #

DATE

Loss Used THIS

_______________________

_______________________________________________________________

PREPARER SS# / FED ID #

PREPARER ADDRESS

YEAR

(Enter Total on

Line 3 above)

Principal Business Activity Code: _________________

Loss Carried

PLEASE ENTER THE CODE REPORTED ON YOUR FEDERAL TAX RETURN

Forward to

NEXT TAX YEAR

TAX PRACTITIONER AKRON ID #

Website:

Telephone number: 330-375-2539

Rev 1/17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2