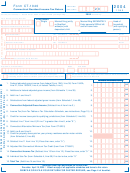

Form Ct-1040 - Connecticut Resident Income Tax Return - 2004 Page 3

ADVERTISEMENT

Form CT-1040 - Page 3

Your Social

Security Number

Schedule 1 - Modifications to Federal Adjusted Gross Income

(Enter all items as positive numbers.)

(See Instructions, Page 18)

31. Interest on state and local government obligations other than Connecticut

31.

,

,

. 00

32. Mutual fund exempt-interest dividends from non-Connecticut state or municipal

,

,

. 00

government obligations

32.

,

,

. 00

33. Special depreciation allowance for qualified property placed in service prior to Sept. 11, 2004 33.

34. Taxable amount of lump-sum distributions from qualified plans not included in federal

,

,

. 00

adjusted gross income

34.

,

,

. 00

35. Beneficiary's share of Connecticut fiduciary adjustment (Enter only if greater than zero)

35.

,

,

. 00

36. Loss on sale of Connecticut state and local government bonds

36.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

37. Allocated for future use

37.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

,

,

. 00

38. Other - specify

________________________________________________________

38.

,

,

. 00

39. Total Additions (Add Lines 31 through 38) Enter here and on Line 2.

39.

,

,

. 00

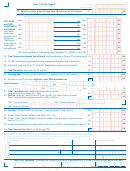

40. Interest on U.S. government obligations

40.

,

,

. 00

41. Exempt dividends from certain qualifying mutual funds derived from U.S. government obligations 41.

42. Social Security benefit adjustment

,

,

. 00

(See Social Security Benefit Adjustment Worksheet, Page 20)

42.

,

,

. 00

43. Refunds of state and local income taxes

43.

,

,

. 00

44. Tier 1 and Tier 2 railroad retirement benefits and supplemental annuities

44.

,

,

. 00

45. Special depreciation allowance for qualified property placed in service during the preceding year

45.

,

,

. 00

46. Beneficiary's share of Connecticut fiduciary adjustment (Enter only if less than zero)

46.

,

,

. 00

47. Gain on sale of Connecticut state and local government bonds

47.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

48. Allocated for future use

48.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8

,

,

. 00

49. Other - specify (Do not include out of state income)

___________________________

49.

,

,

. 00

50. Total Subtractions (Add Lines 40 through 49) Enter here and on Line 4.

50.

Schedule 2 - Credit for Income Taxes Paid to Qualifying Jurisdictions

(You must attach a copy of your return filed with the qualifying jurisdiction(s) or your credit will be disallowed.)

,

,

. 00

51. Modified Connecticut adjusted gross income

51.

(See instructions, Page 24)

COLUMN A

COLUMN B

Name

Code

Name

Code

52. Enter qualifying jurisdiction's name and two-letter code

(See instructions, Page 24)

52.

53. Non-Connecticut income included on Line 51 and

reported on a qualifying jurisdiction's income tax return

,

,

. 00

,

,

. 00

(Complete Schedule 2 Worksheet, Page 23)

53.

.

.

54. Divide Line 53 by Line 51 (may not exceed 1.0000)

54.

,

,

. 00

,

,

. 00

55. Income tax liability (Subtract Line 11 from Line 6)

55.

,

,

. 00

,

,

. 00

56. Multiply Line 54 by Line 55

56.

57. Income tax paid to a qualifying jurisdiction

,

,

. 00

,

,

. 00

(See instructions, Page 25)

57.

,

,

. 00

,

,

. 00

58. Enter the lesser of Line 56 or Line 57

58.

,

,

. 00

59.Total Credit (Add Line 58, all columns) Enter here and on Line 7. 59.

Complete applicable Schedules on Form CT-1040 - Page 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4