Form W1 - Employer'S Withholding Form Quarterly/monthly - City Of Reading, Ohio

ADVERTISEMENT

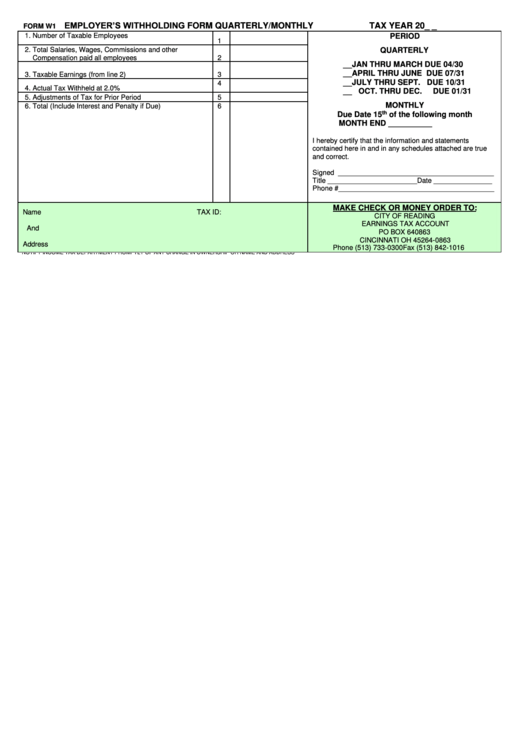

EMPLOYER’S WITHHOLDING FORM QUARTERLY/MONTHLY

TAX YEAR 20_ _

FORM W1

1. Number of Taxable Employees

PERIOD

1

2. Total Salaries, Wages, Commissions and other

QUARTERLY

Compensation paid all employees

2

__ JAN THRU MARCH DUE 04/30

__ APRIL THRU JUNE DUE 07/31

3. Taxable Earnings (from line 2)

3

__ JULY THRU SEPT. DUE 10/31

4

4. Actual Tax Withheld at 2.0%

__ OCT. THRU DEC.

DUE 01/31

5. Adjustments of Tax for Prior Period

5

MONTHLY

6. Total (Include Interest and Penalty if Due)

6

th

Due Date 15

of the following month

MONTH END __________

I hereby certify that the information and statements

contained here in and in any schedules attached are true

and correct.

Signed ________________________________________

Title _______________________Date _______________

Phone #________________________________________

MAKE CHECK OR MONEY ORDER TO:

Name

TAX ID:

CITY OF READING

EARNINGS TAX ACCOUNT

And

PO BOX 640863

CINCINNATI OH 45264-0863

Address

Phone (513) 733-0300

Fax (513) 842-1016

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1