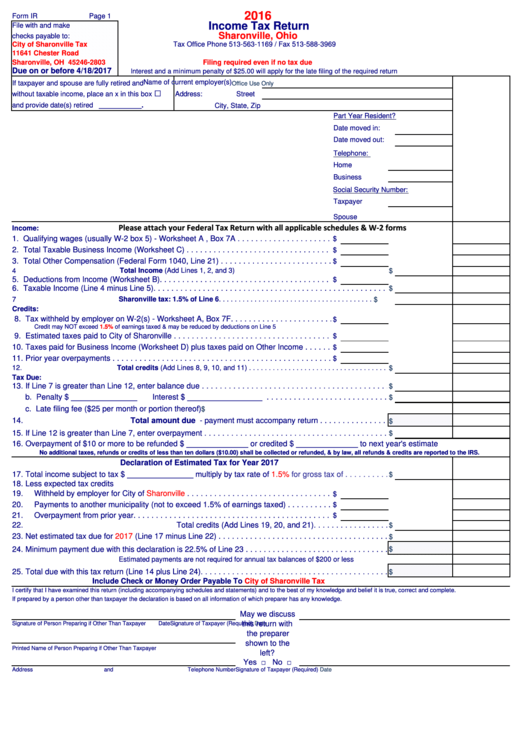

Form Ir - Income Tax Return - Sharonville, Ohio - 2016

ADVERTISEMENT

2016

Form IR

Page 1

Income Tax Return

File with and make

Sharonville, Ohio

checks payable to:

City of Sharonville Tax

Tax Office Phone 513-563-1169 / Fax 513-588-3969

11641 Chester Road

Sharonville, OH 45246-2803

Filing required even if no tax due

Due on or before 4/18/2017

Interest and a minimum penalty of $25.00 will apply for the late filing of the required return

Name of current employer(s)

If taxpayer and spouse are fully retired and

Office Use Only

□

without taxable income, place an x in this box

Address:

Street

and provide date(s) retired ___________.

City, State, Zip

Part Year Resident?

Date moved in:

Date moved out:

Telephone:

Home

Business

Social Security Number:

Taxpayer

Spouse

Please attach your Federal Tax Return with all applicable schedules & W-2 forms

Income:

1. Qualifying wages (usually W-2 box 5) - Worksheet A , Box 7A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

2. Total Taxable Business Income (Worksheet C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

3. Total Other Compensation (Federal Form 1040, Line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Total Income (Add Lines 1, 2, and 3)

4

$

5. Deductions from Income (Worksheet B). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

6. Taxable Income (Line 4 minus Line 5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Sharonville tax: 1.5% of Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

$

Credits:

8. Tax withheld by employer on W-2(s) - Worksheet A, Box 7F. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Credit may NOT exceed

1.5%

of earnings taxed & may be reduced by deductions on Line 5

9. Estimated taxes paid to City of Sharonville . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

10. Taxes paid for Business Income (Worksheet D) plus taxes paid on Other Income . . . . . . . . . . . . . . . . . . .

$

11. Prior year overpayments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

12.

Total credits (Add Lines 8, 9, 10, and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Tax Due:

13. If Line 7 is greater than Line 12, enter balance due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

b. Penalty $ _______________

Interest $ _________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

c. Late filing fee ($25 per month or portion thereof)

$

14.

Total amount due - payment must accompany return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

15. If Line 12 is greater than Line 7, enter overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

16. Overpayment of $10 or more to be refunded $ ______________ or credited $ ______________ to next year's estimate

No additional taxes, refunds or credits of less than ten dollars ($10.00) shall be collected or refunded, & by law, all refunds & credits are reported to the IRS.

Declaration of Estimated Tax for Year 2017

17. Total income subject to tax $ _______________ multiply by tax rate of

1.5%

for gross tax of . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

18. Less expected tax credits

19.

Withheld by employer for City of

Sharonville

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

20.

Payments to another municipality (not to exceed 1.5% of earnings taxed) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

21.

Overpayment from prior year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

22.

Total credits (Add Lines 19, 20, and 21). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

23. Net estimated tax due for

2017

(Line 17 minus Line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

24. Minimum payment due with this declaration is 22.5% of Line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Estimated payments are not required for annual tax balances of $200 or less

25. Total due with this tax return (Line 14 plus Line 24). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Include Check or Money Order Payable To

City of Sharonville Tax

I certify that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete.

If prepared by a person other than taxpayer the declaration is based on all information of which preparer has any knowledge.

May we discuss

Signature of Person Preparing if Other Than Taxpayer

Date

this return with

Signature of Taxpayer (Required)

Date

the preparer

shown to the

Printed Name of Person Preparing if Other Than Taxpayer

left?

Yes □ No □

Address

and

Telephone Number

Signature of Taxpayer (Required)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2