Form Ir - Income Tax Return - Sharonville, Ohio - 2016 Page 2

ADVERTISEMENT

Page 2

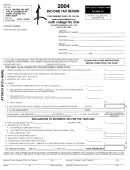

Worksheet A : W-2 Income

A

B

C

D

E

F

Line

Credit Allowed

(Lower of

Local City tax

Column D, E or

W-2 Qualifying

was withheld

Local

Local Taxes

Maximum

100% of tax

Wages

to

Wages

Withheld

Credit (Col.

withheld to

(usually Box 5)

(Box 20)

(Box 18)

(Box 19)

C x 1.5%)

Name of Employer

Sharonville)

1

2

3

4

5

6

Totals:

7

Enter Total in 7A on Page 1, Line 1

Worksheet B: Deductions from Income

Amount

Name of Employer

2106 expenses

8

(Limited to amount deducted on Federal 1040 Schedule A)

(Attach Federal Schedule A and 2106)

3903 expenses

9

(attach Federal 3903)

Total: Enter on Page 1, Line 5

10

B

C

D

Worksheet C:

Net Profit/Loss from Business Activity

Profit

Loss

Total

Schedule C Income

11

Schedule F income

12

Schedule E income from Rental Income

13

Other Schedule E income *

14

Ordinary Income or Loss (attach Federal 4797)

15

Prior Year Loss Carry-Forward

16

(limited to 3 years)

If positive enter Col. D Total on

Totals

17

Page 1, Line 2

If Total Taxable Business Income is negative, no credit is allowed; current year losses may be carried forward for three years

* S Corps and partnerships doing business within the City of Sharonville must file a separate business return to report

income earned in our city.

List each municipality separately & add another page if needed

Worksheet D for Residents Only:

Attach copies of all other local tax returns for credit

Credit for Business Earnings Tax

E

A

B

C

D

Maximum

Local

Credit (Col.

Credit Allowed (Lower of

Municipality taxes were paid to:

Tax Rate

Profit

Taxes paid

B x 1.5%)

Column C or D)

18

19

20

21

22

23

Total Possible Credits

24

Maximum Credit Allowed (Worksheet C, Line 17D x 1.5%)

25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2