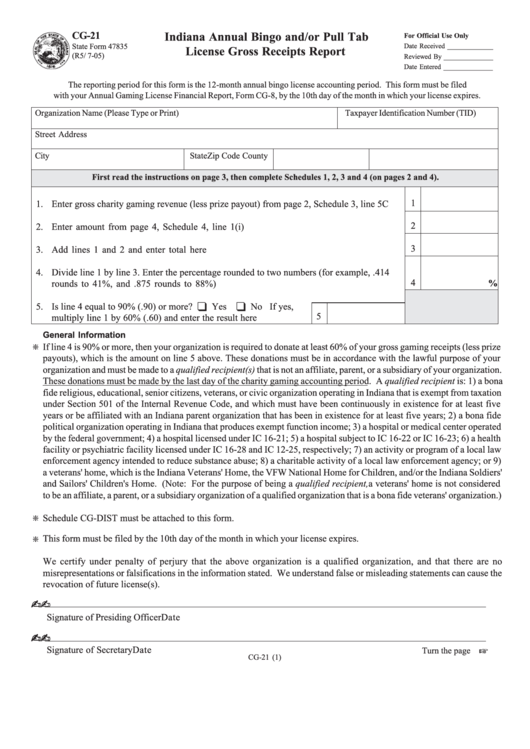

Form Cg-21 - Indiana Annual Bingo And/or Pull Tab License Gross Receipts Report

ADVERTISEMENT

CG-21

Indiana Annual Bingo and/or Pull Tab

For Official Use Only

State Form 47835

Date Received _____________

License Gross Receipts Report

(R5/ 7-05)

Reviewed By ______________

Date Entered ______________

The reporting period for this form is the 12-month annual bingo license accounting period. This form must be filed

with your Annual Gaming License Financial Report, Form CG-8, by the 10th day of the month in which your license expires.

Organization Name (Please Type or Print)

Taxpayer Identification Number (TID)

Street Address

City

State

Zip Code

County

First read the instructions on page 3, then complete Schedules 1, 2, 3 and 4 (on pages 2 and 4).

1

1.

Enter gross charity gaming revenue (less prize payout) from page 2, Schedule 3, line 5C .....

2

2.

Enter amount from page 4, Schedule 4, line 1(i) .................................................................

3

3.

Add lines 1 and 2 and enter total here ...............................................................................

4.

Divide line 1 by line 3. Enter the percentage rounded to two numbers (for example, .414

4

%

rounds to 41%, and .875 rounds to 88%) ...........................................................................

5.

Is line 4 equal to 90% (.90) or more?

Yes

No If yes,

5

multiply line 1 by 60% (.60) and enter the result here .....................

General Information

If line 4 is 90% or more, then your organization is required to donate at least 60% of your gross gaming receipts (less prize

payouts), which is the amount on line 5 above. These donations must be in accordance with the lawful purpose of your

organization and must be made to a qualified recipient(s) that is not an affiliate, parent, or a subsidiary of your organization.

These donations must be made by the last day of the charity gaming accounting period. A qualified recipient is: 1) a bona

fide religious, educational, senior citizens, veterans, or civic organization operating in Indiana that is exempt from taxation

under Section 501 of the Internal Revenue Code, and which must have been continuously in existence for at least five

years or be affiliated with an Indiana parent organization that has been in existence for at least five years; 2) a bona fide

political organization operating in Indiana that produces exempt function income; 3) a hospital or medical center operated

by the federal government; 4) a hospital licensed under IC 16-21; 5) a hospital subject to IC 16-22 or IC 16-23; 6) a health

facility or psychiatric facility licensed under IC 16-28 and IC 12-25, respectively; 7) an activity or program of a local law

enforcement agency intended to reduce substance abuse; 8) a charitable activity of a local law enforcement agency; or 9)

a veterans' home, which is the Indiana Veterans' Home, the VFW National Home for Children, and/or the Indiana Soldiers'

and Sailors' Children's Home. (Note: For the purpose of being a qualified recipient,a veterans' home is not considered

to be an affiliate, a parent, or a subsidiary organization of a qualified organization that is a bona fide veterans' organization.)

Schedule CG-DIST must be attached to this form.

This form must be filed by the 10th day of the month in which your license expires.

We certify under penalty of perjury that the above organization is a qualified organization, and that there are no

misrepresentations or falsifications in the information stated. We understand false or misleading statements can cause the

revocation of future license(s).

Signature of Presiding Officer

Date

Signature of Secretary

Date

Turn the page

CG-21 (1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4