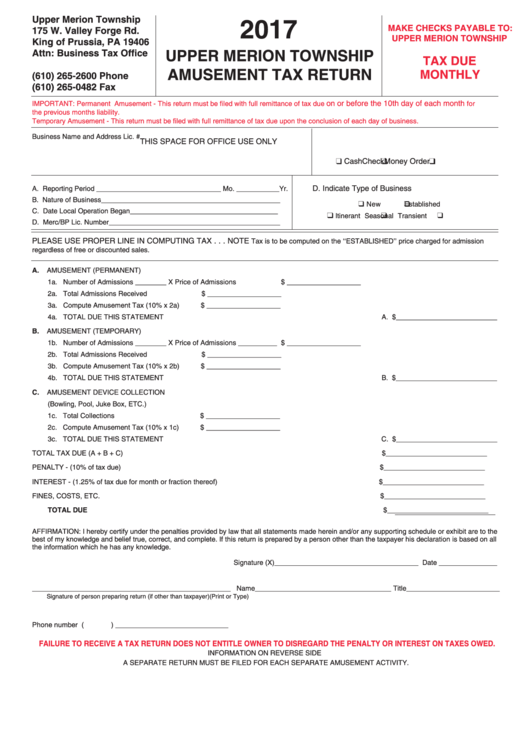

Amusement Tax Return - Upper Merion Township - 2017

ADVERTISEMENT

Upper Merion Township

2017

MAKE CHECKS PAYABLE TO:

175 W. Valley Forge Rd.

UPPER MERION TOWNSHIP

King of Prussia, PA 19406

UPPER MERION TOWNSHIP

Attn: Business Tax Office

TAX DUE

AMUSEMENT TAX RETURN

MONTHLY

(610) 265-2600 Phone

(610) 265-0482 Fax

on or before the 10th day of each month

IMPORTANT: Permanent Amusement - This return must be filed with full remittance of tax due

for

the previous months liability.

Temporary Amusement - This return must be filed with full remittance of tax due upon the conclusion of each day of business.

Business Name and Address

Lic. #

THIS SPACE FOR OFFICE USE ONLY

Cash

Check

Money Order

D. Indicate Type of Business

A. Reporting Period ________________________________ Mo. ___________Yr.

B. Nature of Business ______________________________________________

New

Established

C. Date Local Operation Began

______________________________________

Itinerant

Seasonal

Transient

D. Merc/BP Lic. Number ____________________________________________

PLEASE USE PROPER LINE IN COMPUTING TAX . . . NOTE

Tax is to be computed on the ‘‘ESTABLISHED’’ price charged for admission

regardless of free or discounted sales.

A.

AMUSEMENT (PERMANENT)

1a. Number of Admissions ________ X Price of Admissions

$ ___________________

2a. Total Admissions Received

$ ___________________

3a. Compute Amusement Tax (10% x 2a)

$ ___________________

4a. TOTAL DUE THIS STATEMENT

A. $ __________________________

B.

AMUSEMENT (TEMPORARY)

1b. Number of Admissions ________ X Price of Admissions __________ $ ___________________

2b. Total Admissions Received

$ ___________________

3b. Compute Amusement Tax (10% x 2b)

$ ___________________

4b. TOTAL DUE THIS STATEMENT

B. $ __________________________

C.

AMUSEMENT DEVICE COLLECTION

(Bowling, Pool, Juke Box, ETC.)

1c. Total Collections

$ ___________________

2c. Compute Amusement Tax (10% x 1c)

$ ___________________

3c. TOTAL DUE THIS STATEMENT

C. $ __________________________

TOTAL TAX DUE (A + B + C)

$ __________________________

PENALTY - (10% of tax due)

$ __________________________

INTEREST - (1.25% of tax due for month or fraction thereof)

$ __________________________

FINES, COSTS, ETC.

$ __________________________

TOTAL DUE

$ __________________________

AFFIRMATION: I hereby certify under the penalties provided by law that all statements made herein and/or any supporting schedule or exhibit are to the

best of my knowledge and belief true, correct, and complete. If this return is prepared by a person other than the taxpayer his declaration is based on all

the information which he has any knowledge.

Signature (X)_____________________________________ Date _______________

___________________________________________________ Name___________________________________ Title________________________

Signature of person preparing return (if other than taxpayer)

(Print or Type)

Phone number (

) _____________________________

FAILURE TO RECEIVE A TAX RETURN DOES NOT ENTITLE OWNER TO DISREGARD THE PENALTY OR INTEREST ON TAXES OWED.

INFORMATION ON REVERSE SIDE

A SEPARATE RETURN MUST BE FILED FOR EACH SEPARATE AMUSEMENT ACTIVITY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2