Form 801 - Application For Reinstatement And Request To Set Aside Revocation Or Forfeiture

ADVERTISEMENT

Office of the Secretary of State

Corporations Section

P.O. Box 13697

Austin, Texas 78711-3697

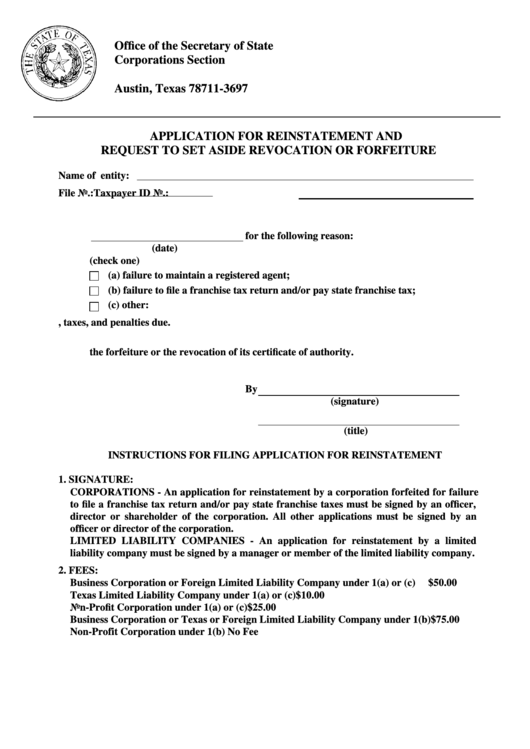

APPLICATION FOR REINSTATEMENT AND

REQUEST TO SET ASIDE REVOCATION OR FORFEITURE

Name of entity:

File No.:

Taxpayer ID No.:

1.

The entity named above was forfeited or its certificate of authority was revoked on

for the following reason:

(date)

(check one)

(a) failure to maintain a registered agent;

(b) failure to file a franchise tax return and/or pay state franchise tax;

(c) other:

2.

The entity has corrected the default and has paid all fees, taxes, and penalties due.

3.

The entity applies for reinstatement and requests that the secretary of state set aside

the forfeiture or the revocation of its certificate of authority.

By

(signature)

(title)

INSTRUCTIONS FOR FILING APPLICATION FOR REINSTATEMENT

1. SIGNATURE:

CORPORATIONS - An application for reinstatement by a corporation forfeited for failure

to file a franchise tax return and/or pay state franchise taxes must be signed by an officer,

director or shareholder of the corporation. All other applications must be signed by an

officer or director of the corporation.

LIMITED LIABILITY COMPANIES - An application for reinstatement by a limited

liability company must be signed by a manager or member of the limited liability company.

2. FEES:

Business Corporation or Foreign Limited Liability Company under 1(a) or (c)

$50.00

Texas Limited Liability Company under 1(a) or (c)

$10.00

Non-Profit Corporation under 1(a) or (c)

$25.00

Business Corporation or Texas or Foreign Limited Liability Company under 1(b)

$75.00

Non-Profit Corporation under 1(b)

No Fee

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2