Net Profit Tax Return Form - City Of Stow, Ohio - 2016 Page 2

ADVERTISEMENT

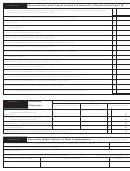

Reconciliation with Federal Income Tax Return Per Ohio Revised Code 718.

SCHEDULE X

1. FEDERAL TAXABLE INCOME BEFORE NET OPERATING LOSSES AND SPECIAL DEDUCTIONS per attached return (Form

1120, Line 28; Form 1120S, Schedule K, Page 3 - Line 18; Form 1120A, Line 24; Form 1120-REIT, Line 20; Form 1065 “Analysis of Net

1.

Income (Loss)”, Line 1; Form 1041, Line 17; Form 990 T, Line 30).........................................................................................................................

2.

2. Income or gain (not loss) from the sale or distribution of property under Sections 1221 or 1231 ...........................................................................

3.

3. Interest earned.........................................................................................................................................................................................................

4.

4. Dividends earned.....................................................................................................................................................................................................

5.

5. Royalty income not subject to municipal taxation....................................................................................................................................................

6.

6. Other exempt income (Attach documentation and/or explanation)..........................................................................................................................

7.

7. TOTAL ITEMS NOT TAXABLE. (Add lines 2 thru 6, enter total here and on Page 1, Line 2B)...............................................................................

8.

8. Total losses under section 1221 (Capital Losses) or Section 1231.........................................................................................................................

9.

9. 5% of expenses not attributable to sale, exchange or other disposition of Section 1221 property..........................................................................

10.

10. Taxes based on income.........................................................................................................................................................................................

11.

11. Guaranteed payments to partners (amount not included in Line 1 above)...........................................................................................................

12.

12. Charitable contributions (over 10% of net profits).................................................................................................................................................

13.

13. Section 179 expenses deducted above corporate limitations as per O.R.C. 718.01 (E)(7).................................................................................

14.

14. Qualified retirement, health insurance and life insurance plans on behalf of owners/owner employees..............................................................

15.

15. Loss carried back or carried forward per Federal return (if included in Line 1 above).........................................................................................

16.

16. Other expenses not deductible (attach documentation and/or explanation).........................................................................................................

17.

17. TOTAL ITEMS NOT DEDUCTIBLE. (Add Lines 8 thru 16. Enter the results here and on Page 1 Line 2A)......................................................

Business

The use of the Business Allocation Formula is mandated by O.R.C. Section 718.

SCHEDULE Y

Allocation

A. LOCATED EVERYWHERE

B. LOCATED IN STOW

C. PERCENTAGE (B÷A)

1. Average Original cost of real and tangible property............ $ ________________________

$ ________________________

Gross annual rental multiplied by 8............................... $ ________________________

$ ________________________

1

%

Total of Step 1......................................................................... $ ________________________

$ ________________________

2. Total wages, salaries, commissions and other

2

%

compensation paid to all employees

$

$

3

%

3. Gross receipts from sales and work or service performed

$

$

4

%

4. Total of percentages

$

$

5

%

5. Average percentage (Divide total percentages by number of percentages used.)

Reconciling Wages, Salaries, & Other Compensations

(Complete if you had Stow employees)

SCHEDULE W

1. Total wages allocated to Stow (from Federal Return or Business Allocation, Schedule Y above, Line 2, Column B)..........................

2. Total Stow wages shown on Form W-3 (Withholding Reconciliation)....................................................................................................

Explain any difference:

Were there any employees that you leased, during the year covered by this return? ___________YES ___________NO If YES, complete the following:

NAME OF LEASING COMPANY

MAILING ADDRESS

FED ID

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2