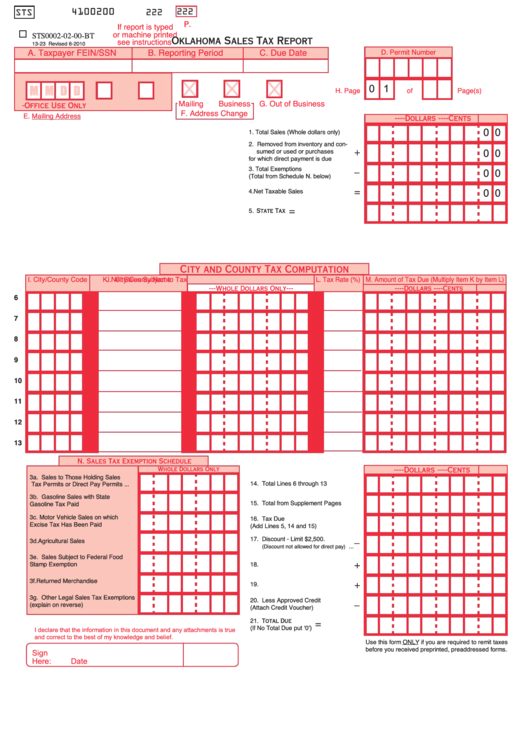

4100200

222

STS

222

P.

If report is typed

or machine printed

STS0002-02-00-BT

Oklahoma Sales Tax Report

see instructions

13-23 Revised 6-2010

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

D. Permit Number

0 1

M M D D

H. Page

of

Page(s)

Mailing

Business

G. Out of Business

F.C.

P.T.

-Office Use Only

F. Address Change

E. Mailing Address

----Dollars ----

Cents

0 0

1. Total Sales (Whole dollars only) ..........

2. Removed from inventory and con-

+

sumed or used or purchases

0 0

for which direct payment is due ......

3. Total Exemptions

–

0 0

(Total from Schedule N. below) .......

=

4. Net Taxable Sales ...........................

0 0

=

5. State Tax ...................................

City and County Tax Computation

I. City/County Code

J. City/County Name

K. Net Sales Subject to Tax

L. Tax Rate (%)

M. Amount of Tax Due (Multiply Item K by Item L)

---Whole Dollars Only---

----Dollars ----

Cents

6

7

8

9

10

11

12

13

N. Sales Tax Exemption Schedule

Whole Dollars Only

----Dollars ----

Cents

3a. Sales to Those Holding Sales

14. Total Lines 6 through 13 ...................

Tax Permits or Direct Pay Permits ...

3b. Gasoline Sales with State

15. Total from Supplement Pages ..........

Gasoline Tax Paid ............................

3c. Motor Vehicle Sales on which

16. Tax Due

Excise Tax Has Been Paid ..............

(Add Lines 5, 14 and 15) ..................

17. Discount - Limit $2,500.

–

3d. Agricultural Sales .............................

...

(Discount not allowed for direct pay)

3e. Sales Subject to Federal Food

+

Stamp Exemption ............................

18. Interest..........................................

3f. Returned Merchandise ....................

+

19. Penalty..........................................

3g. Other Legal Sales Tax Exemptions

20. Less Approved Credit

–

(explain on reverse) .........................

(Attach Credit Voucher) ................

21. Total Due

=

(If No Total Due put ‘0’) .................

I declare that the information in this document and any attachments is true

and correct to the best of my knowledge and belief.

Use this form ONLY if you are required to remit taxes

before you received preprinted, preaddressed forms.

Sign

Here:

Date

1

1 2

2 3

3