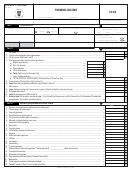

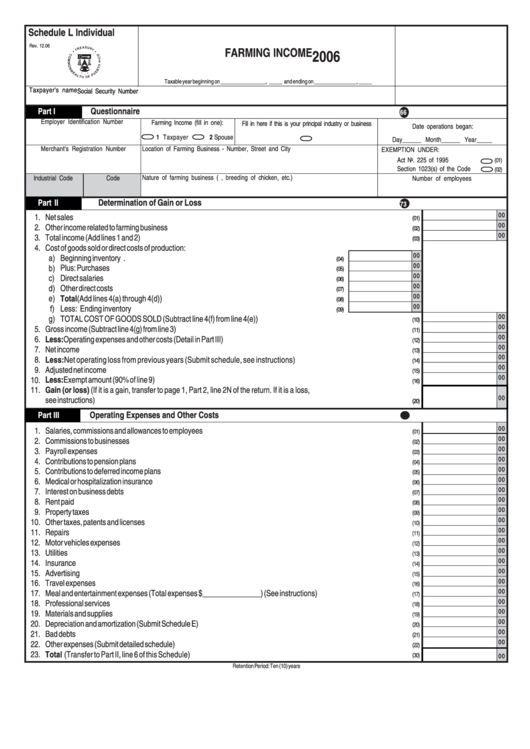

Schedule L Individual - Farming Income - 2006

ADVERTISEMENT

Schedule L Individual

Rev. 12.06

FARMING INCOME

2006

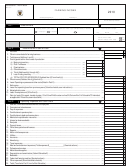

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Questionnaire

66

Employer Identification Number

Farming Income (fill in one):

Fill in here if this is your principal industry or business

Date operations began:

1 Taxpayer

2 Spouse

Day______ Month______ Year_____

Merchant's Registration Number

Location of Farming Business - Number, Street and City

EXEMPTION UNDER:

Act No. 225 of 1995

(01)

Section 1023(s) of the Code

(02)

Nature of farming business (i.e. milk-dairy, breeding of chicken, etc.)

Industrial Code

Code

Number of employees

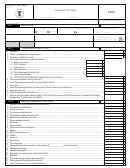

Determination of Gain or Loss

Part II

73

00

1.

Net sales .............................................................................................................................................................................

(01)

00

2.

Other income related to farming business ............................................................................................................................

(02)

00

3.

Total income (Add lines 1 and 2) .........................................................................................................................................

(03)

4.

Cost of goods sold or direct costs of production:

00

a)

Beginning inventory ............................................................................................................

(04)

00

b)

Plus: Purchases ..................................................................................................................

(05)

00

c)

Direct salaries .....................................................................................................................

(06)

00

d)

Other direct costs ................................................................................................................

(07)

00

e)

Total (Add lines 4(a) through 4(d)) ....................................................................................

(08)

00

f)

Less: Ending inventory ......................................................................................................

(09)

00

g)

TOTAL COST OF GOODS SOLD (Subtract line 4(f) from line 4(e)) ...........................................................................

(10)

00

5.

Gross income (Subtract line 4(g) from line 3) .......................................................................................................................

(11)

00

6.

Less: Operating expenses and other costs (Detail in Part III) .............................................................................................

(12)

00

7.

Net income ..........................................................................................................................................................................

(13)

00

8.

Less: Net operating loss from previous years (Submit schedule, see instructions) ......................................................

(14)

00

9.

Adjusted net income .............................................................................................................................................................

(15)

00

10.

Less: Exempt amount (90% of line 9) .................................................................................................................................

(16)

11.

Gain (or loss) (If it is a gain, transfer to page 1, Part 2, line 2N of the return. If it is a loss,

00

see instructions) ..................................................................................................................................................................

(20)

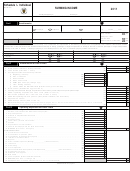

Part III

Operating Expenses and Other Costs

83

00

1.

Salaries, commissions and allowances to employees ..........................................................................................................

(01)

00

2.

Commissions to businesses .................................................................................................................................................

(02)

00

3.

Payroll expenses ................................................................................................................................................................

(03)

00

4.

Contributions to pension plans ...........................................................................................................................................

(04)

00

5.

Contributions to deferred income plans ...............................................................................................................................

(05)

00

6.

Medical or hospitalization insurance ....................................................................................................................................

(06)

00

7.

Interest on business debts ..................................................................................................................................................

(07)

00

8.

Rent paid ...........................................................................................................................................................................

(08)

00

9.

Property taxes ....................................................................................................................................................................

(09)

00

10.

Other taxes, patents and licenses ........................................................................................................................................

(10)

00

11.

Repairs ...............................................................................................................................................................................

(11)

00

12.

Motor vehicles expenses .....................................................................................................................................................

(12)

00

13.

Utilities .................................................................................................................................................................................

(13)

00

14.

Insurance ............................................................................................................................................................................

(14)

00

15.

Advertising ..........................................................................................................................................................................

(15)

00

16.

Travel expenses .................................................................................................................................................................

(16)

00

17.

Meal and entertainment expenses (Total expenses $_______________) (See instructions) ..............................................

(17)

00

18.

Professional services ..........................................................................................................................................................

(18)

00

19.

Materials and supplies ........................................................................................................................................................

(19)

00

20.

Depreciation and amortization (Submit Schedule E) ............................................................................................................

(20)

00

21.

Bad debts ............................................................................................................................................................................

(21)

00

22.

Other expenses (Submit detailed schedule) ........................................................................................................................

(22)

23.

Total (Transfer to Part II, line 6 of this Schedule) ............................................................................................................

(30)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1