Schedule E-2 - Loss Carryover Deduction - 2001

ADVERTISEMENT

2001

Massachusetts

Schedule E-2

Department of

Loss Carryover Deduction

Revenue

Name

Federal Identification number

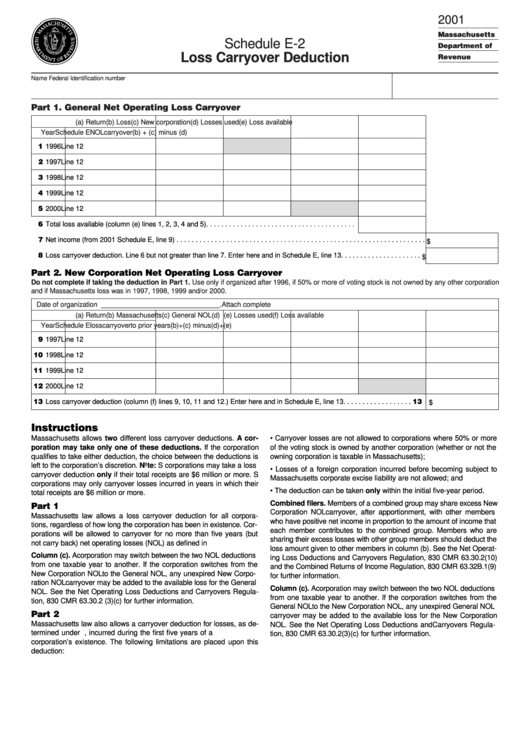

Part 1. General Net Operating Loss Carryover

(a) Return

(b) Loss

(c) New corporation

(d) Losses used

(e) Loss available

Year

Schedule E

NOL carryover

(b) + (c) minus (d)

11 1996

Line 12

12 1997

Line 12

13 1998

Line 12

14 1999

Line 12

15 2000

Line 12

16 Total loss available (column (e) lines 1, 2, 3, 4 and 5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Net income (from 2001 Schedule E, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

18 Loss carryover deduction. Line 6 but not greater than line 7. Enter here and in Schedule E, line 13 . . . . . . . . . . . . . . . . . . . . .

$

Part 2. New Corporation Net Operating Loss Carryover

Do not complete if taking the deduction in Part 1. Use only if organized after 1996, if 50% or more of voting stock is not owned by any other corporation

and if Massachusetts loss was in 1997, 1998, 1999 and/or 2000.

Date of organization _______________________________. Attach complete U.S. schedule of loss carryback and carryforward computation.

(a) Return

(b) Massachusetts

(c) General NOL

(d) U.S. carryback

(e) Losses used

(f) Loss available

Year

Schedule E

loss

carryover

to prior years

(b) + (c) minus (d) + (e)

19 1997

Line 12

10 1998

Line 12

11 1999

Line 12

12 2000

Line 12

13 Loss carryover deduction (column (f) lines 9, 10, 11 and 12.) Enter here and in Schedule E, line 13 . . . . . . . . . . . . . . . . . . 13 $

Instructions

Massachusetts allows two different loss carryover deductions. A cor-

• Carryover losses are not allowed to corporations where 50% or more

poration may take only one of these deductions. If the corporation

of the voting stock is owned by another corporation (whether or not the

qualifies to take either deduction, the choice between the deductions is

owning corporation is taxable in Massachusetts);

left to the corporation’s discretion. Note: S corporations may take a loss

• Losses of a foreign corporation incurred before becoming subject to

carryover deduction only if their total receipts are $6 million or more. S

Massachusetts corporate excise liability are not allowed; and

corporations may only carryover losses incurred in years in which their

• The deduction can be taken only within the initial five-year period.

total receipts are $6 million or more.

Combined filers. Members of a combined group may share excess New

Part 1

Corporation NOL carryover, after apportionment, with other members

Massachusetts law allows a loss carryover deduction for all corpora-

who have positive net income in proportion to the amount of income that

tions, regardless of how long the corporation has been in existence. Cor-

each member contributes to the combined group. Members who are

porations will be allowed to carryover for no more than five years (but

sharing their excess losses with other group members should deduct the

not carry back) net operating losses (NOL) as defined in I.R.C. sec. 172.

loss amount given to other members in column (b). See the Net Operat-

Column (c). A corporation may switch between the two NOL deductions

ing Loss Deductions and Carryovers Regulation, 830 CMR 63.30.2(10)

from one taxable year to another. If the corporation switches from the

and the Combined Returns of Income Regulation, 830 CMR 63.32B.1(9)

New Corporation NOL to the General NOL, any unexpired New Corpo-

for further information.

ration NOL carryover may be added to the available loss for the General

Column (c). A corporation may switch between the two NOL deductions

NOL. See the Net Operating Loss Deductions and Carryovers Regula-

from one taxable year to another. If the corporation switches from the

tion, 830 CMR 63.30.2 (3)(c) for further information.

General NOL to the New Corporation NOL, any unexpired General NOL

Part 2

carryover may be added to the available loss for the New Corporation

Massachusetts law also allows a carryover deduction for losses, as de-

NOL. See the Net Operating Loss Deductions and Carryovers Regula-

termined under I.R.C. sec. 172, incurred during the first five years of a

tion, 830 CMR 63.30.2(3)(c) for further information.

corporation’s existence. The following limitations are placed upon this

deduction:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1