Schedule E-2 - Loss Carryover Deduction - 2000

ADVERTISEMENT

2000

Massachusetts

Schedule E-2

Department of

Loss Carryover Deduction

Revenue

Name

Federal Identification number

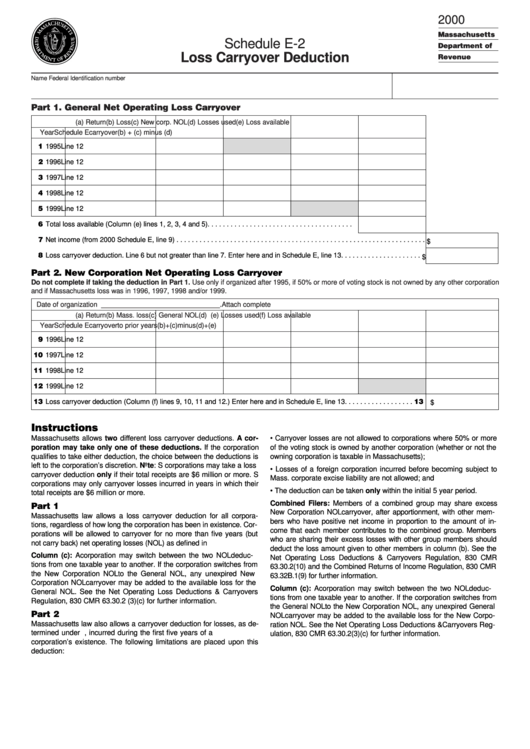

Part 1. General Net Operating Loss Carryover

(a) Return

(b) Loss

(c) New corp. NOL

(d) Losses used

(e) Loss available

Year

Schedule E

carryover

(b) + (c) minus (d)

11 1995

Line 12

12 1996

Line 12

13 1997

Line 12

14 1998

Line 12

15 1999

Line 12

16 Total loss available (Column (e) lines 1, 2, 3, 4 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Net income (from 2000 Schedule E, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

18 Loss carryover deduction. Line 6 but not greater than line 7. Enter here and in Schedule E, line 13 . . . . . . . . . . . . . . . . . . . . .

$

Part 2. New Corporation Net Operating Loss Carryover

Do not complete if taking the deduction in Part 1. Use only if organized after 1995, if 50% or more of voting stock is not owned by any other corporation

and if Massachusetts loss was in 1996, 1997, 1998 and/or 1999.

Date of organization _______________________________. Attach complete U.S. schedule of loss carryback and carryforward computation.

(a) Return

(b) Mass. loss

(c) General NOL

(d) U.S. carryback

(e) Losses used

(f) Loss available

Year

Schedule E

carryover

to prior years

(b) + (c) minus (d) + (e)

19 1996

Line 12

10 1997

Line 12

11 1998

Line 12

12 1999

Line 12

13 Loss carryover deduction (Column (f) lines 9, 10, 11 and 12.) Enter here and in Schedule E, line 13 . . . . . . . . . . . . . . . . . . 13 $

Instructions

Massachusetts allows two different loss carryover deductions. A cor-

• Carryover losses are not allowed to corporations where 50% or more

poration may take only one of these deductions. If the corporation

of the voting stock is owned by another corporation (whether or not the

qualifies to take either deduction, the choice between the deductions is

owning corporation is taxable in Massachusetts);

left to the corporation’s discretion. Note: S corporations may take a loss

• Losses of a foreign corporation incurred before becoming subject to

carryover deduction only if their total receipts are $6 million or more. S

Mass. corporate excise liability are not allowed; and

corporations may only carryover losses incurred in years in which their

• The deduction can be taken only within the initial 5 year period.

total receipts are $6 million or more.

Combined Filers: Members of a combined group may share excess

Part 1

New Corporation NOL carryover, after apportionment, with other mem-

Massachusetts law allows a loss carryover deduction for all corpora-

bers who have positive net income in proportion to the amount of in-

tions, regardless of how long the corporation has been in existence. Cor-

come that each member contributes to the combined group. Members

porations will be allowed to carryover for no more than five years (but

who are sharing their excess losses with other group members should

not carry back) net operating losses (NOL) as defined in I.R.C. sec. 172.

deduct the loss amount given to other members in column (b). See the

Column (c): A corporation may switch between the two NOL deduc-

Net Operating Loss Deductions & Carryovers Regulation, 830 CMR

tions from one taxable year to another. If the corporation switches from

63.30.2(10) and the Combined Returns of Income Regulation, 830 CMR

the New Corporation NOL to the General NOL, any unexpired New

63.32B.1(9) for further information.

Corporation NOL carryover may be added to the available loss for the

Column (c): A corporation may switch between the two NOL deduc-

General NOL. See the Net Operating Loss Deductions & Carryovers

tions from one taxable year to another. If the corporation switches from

Regulation, 830 CMR 63.30.2 (3)(c) for further information.

the General NOL to the New Corporation NOL, any unexpired General

Part 2

NOL carryover may be added to the available loss for the New Corpo-

Massachusetts law also allows a carryover deduction for losses, as de-

ration NOL. See the Net Operating Loss Deductions & Carryovers Reg-

termined under I.R.C. sec. 172, incurred during the first five years of a

ulation, 830 CMR 63.30.2(3)(c) for further information.

corporation’s existence. The following limitations are placed upon this

deduction:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1