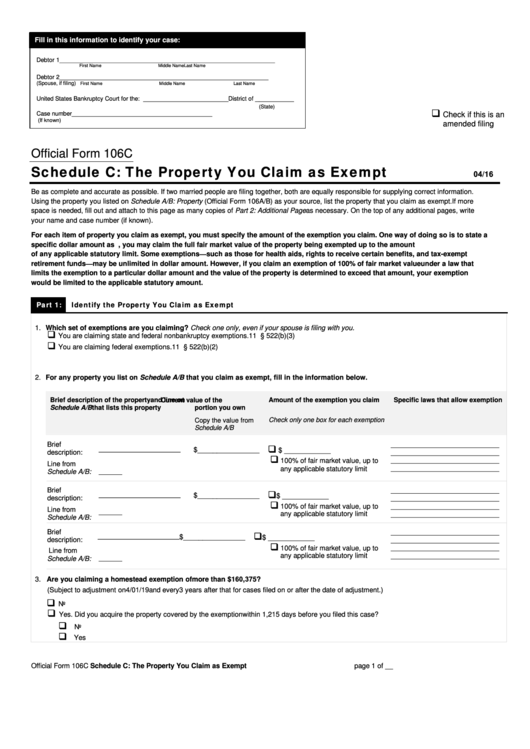

Fill in this information to identify your case:

Debtor 1

__________________________________________________________________

First Name

Middle Name

Last Name

Debtor 2

________________________________________________________________

(Spouse, if filing)

First Name

Middle Name

Last Name

______________________

__________

United States Bankruptcy Court for the:

District of

(State)

Case number

___________________________________________

Check if this is an

(If known)

amended filing

Official Form 106C

Schedule C: The Property You Claim as Exempt

04/16

Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.

Using the property you listed on Schedule A/B: Property (Official Form 106A/B) as your source, list the property that you claim as exempt. If more

space is needed, fill out and attach to this page as many copies of Part 2: Additional Page as necessary. On the top of any additional pages, write

your name and case number (if known).

For each item of property you claim as exempt, you must specify the amount of the exemption you claim. One way of doing so is to state a

specific dollar amount as exempt. Alternatively, you may claim the full fair market value of the property being exempted up to the amount

of any applicable statutory limit. Some exemptions—such as those for health aids, rights to receive certain benefits, and tax-exempt

retirement funds—may be unlimited in dollar amount. However, if you claim an exemption of 100% of fair market value under a law that

limits the exemption to a particular dollar amount and the value of the property is determined to exceed that amount, your exemption

would be limited to the applicable statutory amount.

Part 1:

Identify the Property You Claim as Exempt

1. Which set of exemptions are you claiming? Check one only, even if your spouse is filing with you.

You are claiming state and federal nonbankruptcy exemptions. 11 U.S.C. § 522(b)(3)

You are claiming federal exemptions. 11 U.S.C. § 522(b)(2)

2. For any property you list on Schedule A/B that you claim as exempt, fill in the information below.

Brief description of the property and line on

Current value of the

Amount of the exemption you claim

Specific laws that allow exemption

Schedule A/B that lists this property

portion you own

Check only one box for each exemption.

Copy the value from

Schedule A/B

Brief

____________________________

_________________________

$________________

$ ____________

description:

____________________________

100% of fair market value, up to

____________________________

Line from

____________________________

any applicable statutory limit

______

Schedule A/B:

Brief

____________________________

_________________________

$________________

$ ____________

description:

____________________________

____________________________

100% of fair market value, up to

Line from

______

____________________________

any applicable statutory limit

Schedule A/B:

Brief

____________________________

_________________________

$________________

$ ____________

description:

____________________________

____________________________

100% of fair market value, up to

Line from

____________________________

any applicable statutory limit

Schedule A/B: ______

3. Are you claiming a homestead exemption of more than $160,375?

(Subject to adjustment on 4/01/19 and every 3 years after that for cases filed on or after the date of adjustment.)

No

Yes. Did you acquire the property covered by the exemption within 1,215 days before you filed this case?

No

Yes

Official Form 106C

Schedule C: The Property You Claim as Exempt

page 1 of __

1

1 2

2