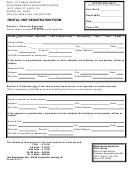

Residential/commercial Rental Business Registration Form - Alabama Page 2

ADVERTISEMENT

BUSINESS REGISTRATION FORM (CITY OF AUBURN, AL)

Page2

TAX/LICENSING INFORMATION: (Attach additional sheet(s) if necessary)

Note: Each property must be listed individually (i.e. each side of duplex or unit of a condo listed separately)

1. Property Address: ________________________________________________________________________________

Property Type:

___House

___Duplex

___Condo

___Apartment Complex

___Commercial Proprerty

Date Property First Rented/Leased: ______________________

Are you the owner of the property? _____

If no, provide name/contact number of property owner: _____________________________________________________

Are you the manager of the property? _____

If no, provide name/contact number of property manager: __________________________________________________

Do you live in any portion of the property? ______ If yes, do you rent any portion of the property? _______

2. Property Address: ________________________________________________________________________________

Property Type:

___House

___Duplex

___Condo

___Apartment Complex

___Commercial Proprerty

Date Property First Rented/Leased: ______________________

Are you the owner of the property? _____

If no, provide name/contact number of property owner: _____________________________________________________

Are you the manager of the property? _____

If no, provide name/contact number of property manager: __________________________________________________

Do you live in any portion of the property? ______ If yes, do you rent any portion of the property? _______

st

th

st

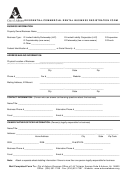

INITIAL (FIRST YEAR) LICENSE FEES:

Start Date Jan 1

– Jun 30

Start Date July 1

or Later

• Residential

$100 plus $5 issuance fee

$50 plus $5 issuance fee

• Commerical

$100 plus $5 issuance fee

$50 pus $5 issuance fee

RENEWAL LICENSE FEES:

•

Residential: 1 ½% of gross rental income received in previous year, provided minium license fee requirement of

$100 is met plus the $5 issuance fee

•

Commerial: 1/40 of 1% (.000250) of gross rental income received in previous year, provided minimum license fee

requirement is met plus the $5 issuance fee

Note1: If you are a property management company and manage properties for more than one property owner, each

property owner must meet the $100 minium license fee requirement for both the residential and commercial business

license if they own both property types.

st

st

th

th

Note2: Licenses expire on Dec 31

and are renewable between Jan 1

– Feb 15

. If renewed after Feb 15

, a 15%

th

penalty will be added. Licenses renewed 30 days after the delinquent date of Feb 15

shall be assessed a late penalty

of 30%.

PAYMENT INFORMATION: Payments may be at the Revenue Office, via US Mail, or over the phone (credit card only).

Accepted Forms of Payment: Cash, Check, Money Order, Credit Card (Visa/MasterCard ONLY)

Under penalties of perjury, I declare that I have examined this form and to best of my knowledge and belief, it is true,

correct, and complete. My signature indicates that I take full responsibility for the information presented on this form and

any tax liability that might occur.

_________________________________________________________

__________________________

Signature of person legally responsible for this account

Date

_________________________________________________________

Print the name of the person legally responsible for this account

Mail Completed Form To: City of Auburn-Revenue Office at 144 Tichenor Avenue∙Suite 6∙Auburn, AL 36830

Office: (334) 501-7239 ∙ Fax: (334) 501-7297 ∙ Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2